From understanding the popularity of a product to the quality of service delivered, success metrics can help any organisation understand the path they’re on and, more importantly, where it’s leading them. Defining what constitutes success or failure is a key part of business.

Every organisation has standards by which they measure product performance, whether that’s revenue generated, customer lifetime value, customer acquisition costs (CAC), retention rate, net promoter score or otherwise.

But while we’re all no doubt familiar with some (or perhaps all) of these metrics, what do they mean and what do you need to know?

In this guide, we’ll look at the issue of product metrics as they relate to business and how to use them to understand success and failure. Furthermore, we’ll provide valuable information on how executives can utilise the information here to support future product planning.

Get started on your PX journey with our free product research survey template

What are product metrics?

Product metrics are key metrics (or performance indicators) that help businesses and organisations understand several things:

- User behaviour towards their products and services (including how they’re interacted with)

- Revenue generated by products (including monthly recurring revenue)

- Customer lifetime value (CLTV or LTV)

- Customer acquisition costs (CAC)

- Retention and churn

- Customer satisfaction (CSAT)

And much more.

Now, these metrics are essential for product teams and product managers as they provide insight into the pros and cons of different products after launch, and a roadmap for improvements over time.

Furthermore, as well as providing a product team with insights for individual product performance, they can also — depending on the overall goals — provide critical business insights when it comes to key decisions or forecasts.

For example, they can help guide product changes or updates, measure the success of new product features, segment audiences, and forecast revenue. Let’s say based on your product performance metrics, you’ve discovered a specific customer segment demonstrates a higher propensity to buy. From there, you can alter your marketing and sales strategy to develop several tiers for your offerings, enabling customers to choose the options that best suit their needs without alienating any of your existing segments.

Here’s another instance — let’s say you’ve looked at your product metrics and identified that CSAT scores are significantly higher when new features are added to your products and services. This considered, you can develop a product update schedule and share a public version with your customers. This’ll not only keep them engaged and interested, it’ll also increase their likelihood to purchase.

Without collecting and analysing product metrics, businesses would have no way of making informed decisions about product development, marketing and sales strategy, or customer engagement.

However, while product metrics provide a great overview of how the average customer interacts with or uses a product or service, they’re not limited to just product development.

By looking at the right metrics, you can build a holistic view of user behaviour, the customer journey and more.

Product metrics vs business metrics

Firstly, there’s a considerable difference between product metrics and wider business metrics.

Product metrics provide objective data on how users interact with products and their opinions on them. For example, the number of active users, engagement metrics (such as adoption rate), retention, churn, feature usage.

A SaaS company could use product metrics to understand how a feature update improves (or hampers) the customer experience.

Business metrics, on the other hand, provide a wider picture of the overall business success. For example, overall revenue and profits and cash forecasts.

That said, you can use product metrics as a precursor to predict business outcomes, product success and new opportunities.

Let’s look at the different types of product metrics and how they can be used to judge both product and business success.

Types of product metrics

Customer lifetime value

Customer lifetime value allows you to work out how much money a customer will generate in the long term.

Calculating a customer’s lifetime value is simple: you simply take the average order value and multiply it by the frequency of purchase and average customer lifespan.

For example, one of your customers might purchase $100,000 worth of goods annually and stay with you for 5 years. Their lifetime value is $500,000.

You can also use customer lifetime value to guide marketing teams on the types of leads and prospects they should target, e.g. targeting lookalike customers — prospects similar to your longest lifetime value customers. This approach enables you to net customers who are most likely to spend and stay with you for a long period.

Finally, customer lifetime value is incredibly useful when you want to understand how much you should spend on customer acquisition. You can compare average customer lifetime value against the cost of acquiring a new customer. Let’s look at that next.

Customer acquisition cost

Customer acquisition cost (CAC) represents the average spend your company incurs to win new customers.

Again, this is easy to calculate: take the total cost of marketing and sales and divide it by the number of new users who become customers.

So if you spend €100,000 and gain 10 new customers, your cost of acquisition is €10,000.

It’s also useful when it comes to identifying your target audience and whether your marketing and sales activities are focusing on the right topics. For example, you might find that it costs you significantly less to acquire your ideal ‘target’ customer compared to others. On the other hand, you might find new target markets or segments that you hadn’t considered before.

Monthly recurring revenue

Your monthly recurring revenue (MRR) is the predictable total revenue generated by your business every month.

Understanding MRR is key when it comes to financial forecasting and planning investments in your business. Why? Because it can provide valuable insight into your company’s financial health and stability and also help to identify trends in sales throughout the year.

For example, if you run a retail store, you might find that your MMR is significantly higher during holiday periods or seasonal sales compared to other months as you attract more customers.

To calculate MMR, take the total number of customers you have, and multiply that by the amount each customer pays monthly.

For example, if you have 10 subscription customers paying $10,000 a month to use your software, your MRR is $100,000.

Find out how to create a successful product launch that drives sales

Let’s move on to product engagement metrics.

Product engagement metrics

Product engagement metrics are used to judge how customers are using your products (whether you’re providing an application, a website, a bit of software or otherwise) and in what numbers.

They typically include:

Daily active users

This metric measures the number of users your product has daily.

An ‘active user’ is anyone who views or opens the product daily. On its own, however, it’s considered a vanity metric — but understanding daily active users can help you uncover usage trends and measure the immediate impact of new product features (or the removal of old ones).

Monthly active users

This metric measures the number of active users your product has over a monthly period.

Monthly users can be a good metric for judging the overall health of your business, for example, people logging into your app, website, downloading your software, viewing a post or completing a specific event.

Time in-app (or session duration)

Session duration can be used to judge the usability and popularity of a product based on how long a customer uses it once they start to engage with it.

The longer a customer uses the product, the more successful it is.

Feature usage

Tracking which features are used, how frequently and who is using them can give your team much-needed insight into your best features and customers.

For example, if there’s a feature that’s rarely used, that may indicate that it’s not valuable to customers and that you should consider sunsetting it. It can also indicate that a feature is too complex to use or difficult to access. Whatever it is, it’s worth investigating to find out why.

Features that are routinely used are valuable and you should try to invest more in the most successful elements of your products.

Finally, who is using these features? If a feature finds minimal use but is being used by your highest-paying customers, perhaps it’s time to set up a product tiering system to market that feature more effectively.

Session per user

This is a good metric to understand how many times a user comes back and uses your product over a particular period.

For example, three sessions per user over a week.

Goal completion

Goal completions are particularly useful for marketing teams as it helps to judge the success of a marketing campaign. For example, downloading a particular piece of content or the number of sales inquiries.

Ultimately, analysing goal completions helps you to see how many users are doing what you want them to do, and how you can increase that number.

Retention rate

Customer retention rates are useful as a general guide for the overall success or popularity of your product or service.

High retention rates are a good barometer that customers are satisfied with your product or service.

You should look at retention rates over a daily, weekly and monthly period to ascertain when users are leaving your product. From there, you can devise a strategy to improve the experience at every touchpoint.

Churn rate

On the other hand, customer or revenue churn is an indication that customers may not be happy using your products or services.

This is a particularly useful metric when it comes to future planning, particularly when looking at overall product or feature usage, and it can help you understand whether the decisions you’re taking are popular with customers or not.

Product metrics that judge user satisfaction

Finally, you have product metrics that can help you understand the opinions of customers and how satisfied they are with your products and services or whether you need to make changes.

These customer-oriented metrics are key to help guide any product changes you might need to make based on real customer feedback:

Net promoter score (NPS)

A net promoter score (NPS) is one of the more key performance indicators that can be used to measure customer loyalty with regards to your products and services.

NPS is calculated using quantitative or qualitative results of surveys from your active users to help understand their opinions of your product and service quality.

You can also use these metrics to be more specific on feature updates to understand how your product development is impacting customer loyalty.

Customer satisfaction score (CSAT)

CSAT shows you a user’s overall content or discontent with your product. You ask them to rank your product on a scale, e.g 1-3, 1-5, 1-10, etc., and then you take a sum of the scores divided by the total number of respondents.

CSAT is different from NPS — while NPS measures overall satisfaction, CSAT measures a user’s satisfaction with a specific feature inside your product.

How to develop a product metrics framework

A product metric framework should align with your business objectives and product development process. In doing so, you ensure you’re constantly looking to satisfy your customers while sticking to your business’ key philosophies.

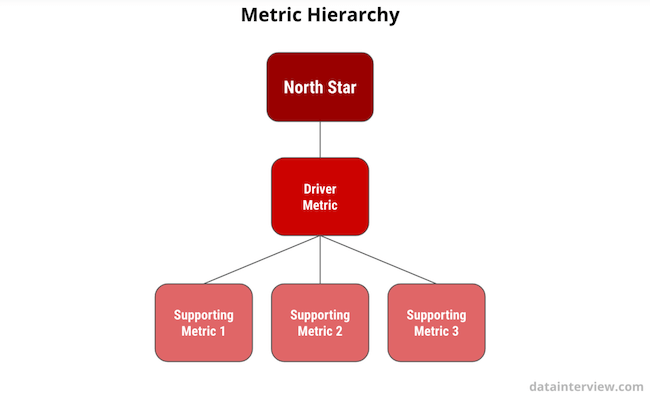

A product metric framework typically contains three elements:

- A mission statement

- A ‘North Star’ metric

- Key driver metrics

Find out more about product research

Mission statement

Your company’s mission statement is used to define your purpose and beliefs. You then circulate it with customers so they know what you stand for. Finally, your mission statement should guide your product strategy.

For example, Tesla’s mission statement is to: “Accelerate the world’s transition to sustainable energy.” To that end, Tesla creates innovative energy-efficient vehicles, storage systems, battery packs and other solutions to support the transition to sustainable energy.

LinkedIn’s mission statement is: “To connect the world’s professionals to make them more productive and successful.” To that end, LinkedIn constantly updates its platform to provide tools for professionals to connect with others, showcase their work, share ideas, liaise with recruiters and much, much more.

They’re even building learning and development programs into their product with LinkedIn learning, not only helping users to get the most out of the product, but also improve their business skills in the process.

North Star metric

Your mission statement aligns your product strategy — sure, but it’s also your leading indicator or North Star.

Of all the metrics you’ll use to judge the success of your product or service, the North Star is the most pivotal as it’s the one you work towards.

Using LinkedIn as an example, their mission statement is to: “Connect the world’s professionals to make them more productive and successful.”

Their leading metric, therefore, is whether customers find LinkedIn makes it easier for them to network, learn and increase their productivity. As such, LinkedIn product managers will constantly review net promoter scores, engagement rates, feature usage and customer behaviour when using LinkedIn to judge the success of their product development.

Driver metrics

Driver metrics are the additional product and business metrics you’ll use to ensure everything you do is for the sake of your North Star.

Choosing the right metrics here is important as they ensure you’re focusing on the right things — those that enhance the customer experience, achieve your business goals and help grow your operations.

For example, if your mission is to deliver an exceptional customer experience at every touchpoint, what metrics or activities contribute to that? What are your key drivers for your mission? You might look at customer satisfaction scores, overall engagement, customer acquisitions, number of tickets closed and so on.

From measuring metrics to customer success

Collecting product metrics is important but they’ll only get you so far without the right software and analysis to help you make sense of them.

And with the right strategy and technology, you can identify the key drivers, metrics and even product features that contribute to customer relationship health, positive sentiment and long-term business success.

With Qualtrics Conjoint Analysis, it’s never been easier to get to the core of your customers’ Product Experience. Our choice-based model allows your respondents to provide feedback so you can narrow down the types of packages, products and features you should offer.

At its core, conjoint analysis is a market research technique (the foundation of all great experiences) that enables you to identify consumer preferences and evaluate the product trade-offs they would make.

Through conjoint analysis, you can bolster your product metrics as you’re focusing on the key elements of your packages, products, features that drive growth, customer satisfaction and business success.

Want to redefine your product success and take the guesswork out of developing products that customers will love?

Get started on your PX journey with our free product research survey template