What is a retention bonus?

Employee retention bonuses (ERBs), also known as retention pay, retention package, or a stay bonus, is a tool used by employers to help attract or keep key employees with the company.

A retention bonus is an amount of money (a lump sum) that is paid to the employee from the company, in exchange for the employee staying for an agreed period of time. It is paid one-time and usually is a significant percentage (20-30%) of the base pay of the employee.

81% of the largest companies with over 20,000 employees use retention bonuses.

Why are retention bonuses important?

Using ERBs as a tool can benefit the overall employee experience in your company. When you encourage employees to remain in the company, this impacts the Intent to Stay (ITS) – an employee experience key performance indicator metric that measures how probable that an employee willingly commits to staying.

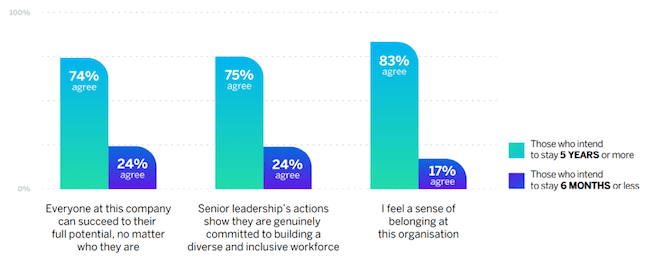

Our 2022 EX trends report shows that the happier employees are in their role and company, the longer they intend to stay in a company:

In this way, high ITS can indicate employees are having better experiences. In the case of retention bonuses, when employee experience is high:

- Employees feel more valued: Being on the receiving end of a retention bonus can make employees feel appreciated. The company is declaring that the employee’s work and skills are valuable to them and that they want to keep them on board.

- Productivity increases: Having a monetary lump sum encourages greater productivity and involvement because the employee knows there is an expectation of delivering good work in return.

- Sales increase: When employees work harder because they have received a retention bonus, or that they may get one, this can lead to more sales if more products or services are sold.

- Your employee loyalty improves: Happier employees are more likely to recommend your brand to friends, family, and potential new recruits.

A retention bonus is a great tool to encourage ITS, but shouldn’t be the only tool in your toolbox when it comes to retaining your employees. Creating an overall positive employee experience is your goal.

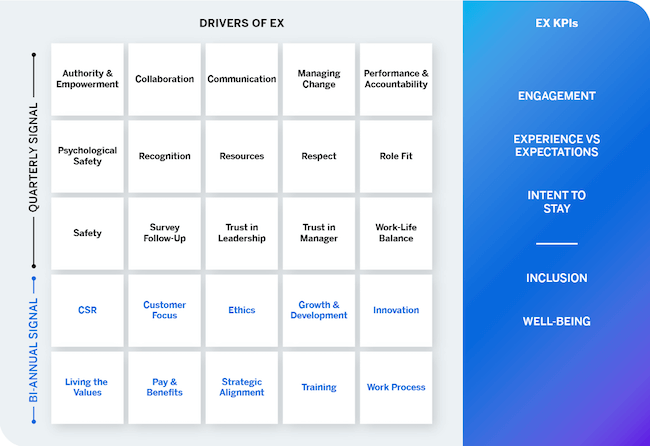

At Qualtrics, we’ve devised our own methodology about how to create a great overall employee experience. It’s called EX25.

What is EX25?

EX25 describes the 25 drivers of the employee experience (EX), one of which is pay and benefits. These drivers are critical to build a great employee experience.

The key performance indicators (KPIs) of a good employee experience are:

- Intent to stay

- Experience vs expectation

- Engagement

- Inclusion

- Well-being

In other words, if you’re getting the drivers right – your people will be happy, engaged, feel included, have high well-being, and are likely to stay at your company.

Using a retention bonus can be a useful part of pay and benefits, but they shouldn’t be used as a silver bullet. If you’re getting your drivers right then you may not need to use them. However, they can be useful in certain circumstances.

Read more about Intent to Stay and the EX25 drivers by downloading this free guide

8 reasons why you may use a retention bonus

- The employee has skills that need to remain in the company: owners want to make sure that they keep the best talent in their company as finding people and training them up is hard to do.

- The company is going through change (merger or acquisition) or tough times: It is tempting for a valued employee to look elsewhere when there is uncertainty about the future of the business. A retention bonus is a step to encourage loyalty and faith in the company.

- The company wants to improve its negotiation hand: When attracting an employee to the company, a retention bonus may act as a sign-on bonus during the negotiation stage to improve the employment offer.

- The company wants to prevent employee poaching by competitors: Replacing great employees can be hard to do in a competitive marketplace. When you identify excellent employees, prevent them from being poached with a retention bonus.

- A retention bonus is a limited amount in a one-off payment: A retention bonus is cost-effective because it is limited in the amount it is and is paid once. This is less money over the long term than committing to an increase to an employee’s base pay.

- A retention bonus keeps vital core business functions running smoothly: Especially when there is change, key staff members like managers and leaders will be needed to keep the company and teams on course.

- The availability of retention bonuses keeps morale levels high: When a key employee leaves, this has a knock-on effect on their team and internal relationships. Companies can keep morale high by keeping these employees in post with a retention bonus.

- Stable company performance will keep outside investment stable: If a company has investors, the investors will want reassurance that the company can continue to deliver. If they don’t see this, they may pull out funds and avoid further investment.

48% of employees surveyed in the Bureau of Labor Statistics said a bonus would encourage them to stay in their job.

Discover the ROI of improving your employee experience with our ROI Calculator

How to set up retention bonuses in your company

How are retention bonuses calculated?

As a retention bonus is not part of the employee’s salary and is instead considered as supplemental wages, this is still seen as income by the IRS.

Therefore, an employer needs to be aware of the tax implications for employees. The income from retention bonuses would be part of the employee’s yearly taxes. There are two methods for how taxes would be applied to the lump sum:

- Aggregate method: Your retention bonus is added to your annual salary. This new figure is used to develop the tax rate and provided through your W-4 form. This method might result in a higher tax rate as the employer withholds tax.

- Percentage method: This method uses a tax rate of 25% as standard, however, for any amount over $1 million, a tax rate of 39.6% would be applied.

For more details, a tax professional can assist you with choosing the right method for your business and in each employee’s case.

What percentage should be used for the retention bonus?

The exact amount of a retention bonus is based on a number of factors:

- The employee’s role

- The employee’s base salary

- The employee’s length of service in the company

- The retention period

- The company’s financial situation

- How much money is available to give to a retention bonus

- The impact of the departure of the employee to the business

The retention bonus percentage can be from 10% to up to 25% of the employee’s annual wage.

What does the company need to include in the agreement?

Companies need to be clear in agreements what is being offered and how. This requires clear communication in writing about the following:

- The retention period the employee is agreeing to by staying with the company

- The value of the retention bonus that is being provided, and how the calculation was made and based on what factors

- The relevant tax method being used by the employer, so that the employee is aware of their tax obligations

- The delivery method of the retention bonus to the employer (will this be delivered in parts or as a lump sum? Will it be delivered on month 15 after a 12 month retention period has elapsed, or will it be delivered upfront at the beginning of the agreed retention period?)

- Any stipulations that the retention bonus is reliant on, such as productivity goals or the completion of a project by a set deadline

- What the role and deliverables are for the remaining employee, to make it clear to the employee about how they will be working with the company and what they are responsible for

- Whether there is a knock-on effect to other employee benefits (like severance pay) and what they are, based on the taking of the retention bonus or the uncertainty of the future of the company (in case of a merger or tougher times)

The contract should be worded so that there is clear language and consistent terms used to describe the elements of the contract. Examples of retention bonus contracts can be found online, or speak to your in-house legal team for more information.

What happens when a retention bonus has been offered?

So, you have finalised and delivered the contract. Both parties – the employee and the company representative must sign and the terms of the agreement are carried out.

Gauge your employees’ happiness with our free Employee Satisfaction Survey template

How can we help you with retention bonuses?

We provide all-in-one tools that help you communicate clearly with your employees, and receive information instantaneously. If you’re trying to understand the landscape of opinion on whether employees want to be considered for a retention bonus, you can easily submit a survey to current and new employees to determine the attitude to bonuses and what would be a good number. This can be valuable research that you can carry out quickly with easy templates, helping you to avoid overpaying and impacting your finances.

Not only will communications out to your employees show that you’re valuing employee opinions and want to make them a part of the process, but it also provides clear evidence of the employee’s willingness to remain and support the business. This can be crucial in negotiating retention bonus offers at the contract stage, plus it also boosts employee morale and level of employee satisfaction. This can in turn increase the likelihood that employees will support the amount offered.

Retention bonuses are an effective tool in improving the employee experience and this can have a real financial impact on the company’s bottom line.

Learn more about employee experience strategy and how to set up an effective plan using the Qualtrics EX25 framework. This defines the key metrics and the 25 driving topics, defined by our in-house team of organisational psychologists, that every company should be measuring.

eBook: Employee Experience Trends Report 2022