What is customer satisfaction (CSAT) survey?

A customer satisfaction (CSAT) survey is used to determine a CSAT score by asking customers the question ‘How satisfied are you with [organization]? Answers range from 1-5 with 5 being “highly satisfied” and 1 being “highly unsatisfied”.

They are used to understand your customer’s satisfaction levels with your organization’s products, services, or experiences. This is one type of customer experience survey and can be used to gauge customers’ needs, understand problems with your products and/or services, or segment customers by their score. They often use rating scales to measure changes over time, and gain a deeper understanding of whether or not you’re meeting the customer’s expectations.

Get started with our free customer satisfaction survey template

Why use customer satisfaction surveys?

Customer satisfaction is at the core of human experience, reflecting customers’ liking of a company’s business activities. A customer satisfaction survey is a great way to understand how your customer feels about your business and their customer journey, and to nail down exactly what new customers might like about your offering.

There are several reasons why measuring your audience’s views with a customer satisfaction survey can be beneficial to your brand.

Customers will leave if they don’t feel like their experience was worth it

Our recent 2022 Global Consumer Trends Report found that 62% of customers think brands need to care about them more. With 9.5% of your revenue at risk from customers walking after a bad experience, knowing how your customers feel is financially beneficial. Gathering feedback via a customer satisfaction survey means you can figure out how to care for customers – and to monitor changes in customer sentiment before small issues become real problems.

A satisfying customer experience is worth the money for your target audience

Our research also found that 60% of consumers would buy more if businesses treated them better. Measuring which interactions and experiences your customers value will help you to judge what they will pay more for.

Satisfied customers will spread the word

Americans will mention a positive experience to an average of nine people and a negative experience to an average of 16. This can have a knock-on effect for your brand reputation. According to Nielsen, 84% of consumers they surveyed thought word-of-mouth was the most trustworthy recommendation type. With every experience potentially attracting or pushing away future customers that hear of you this way, it’s vital to monitor how your customers feel with a customer satisfaction survey.

Satisfaction is a great indicator of retention, loyalty, and likelihood to repurchase

High levels of satisfaction (with pleasurable experiences) are strong predictors of customer and client retention and product repurchase. Customer satisfaction data that answers why loyal customers or clients enjoyed their experience helps the company recreate these experiences in the future. Effective businesses focus on creating and reinforcing world-class experiences so that they retain existing customers and add new customers.

A well-timed customer satisfaction survey can help you hone your customer journey

Mapping your customer journey is an important step of understanding your customers’ interactions with your brand – and for building out your customer lifecycle. However, it’s not enough to just create your journey map. You need to know how your customers feel at each stage of their experience with your brand, from the first interaction to getting in touch with customer service representatives, to making a purchase. A customer satisfaction survey can put your finger on the pulse of customer sentiment and give you a great sense of where your journey needs updating maximum efficacy.

How do I measure customer satisfaction?

To understand how satisfied your customers are, you need to understand the key drivers behind their experiences. The best way of discovering not only how your customers feel, but what has caused them to feel the way they do is by creating customer satisfaction surveys.

However, customer satisfaction feedback can be nebulous. Giving your customers a framework for their feedback – such as likelihood to recommend with a scale of 0 – 10 – can help you contrast and compare answers over time, as well as develop insights and action across multiple relationships.

Choosing the type of customer satisfaction survey you wish to create will help you to develop a metric for measuring – and improving – your customer satisfaction.

Types of customer experience surveys

There are a few ways you can measure customer experience through customer or client satisfaction surveys. The first question you need to answer is what metrics you want to use.

The most commonly used metrics are:

- Net Promoter Score (NPS) ® – Probably the most popular measure of customer affinity towards your company. Created and trademarked by Bain & Company, the net promoter system involves a quick survey that typically asks “How likely are you to recommend [company name] to a friend” with a Likert scale question from 0-10

- Customer Effort Score (CES) – This metric measures how hard it was for a customer to be able to complete the task that prompted their interaction. This survey question could look like, “How easy was it to deal with our company today?” This survey and measurement system can be useful for post-interaction surveys with customer service or support teams

- Customer Satisfaction (CSAT) – This is a commonly used measure for product and services to rate how happy consumers are with what they purchased. The typical survey question to collect this feedback looks like, “How would you rate your overall satisfaction with the [goods/service] you received?” then offers a Likert scale question type between 1-5 with 5 being “highly satisfied” and 1 being “highly unsatisfied”

In this article, we will be focusing on customer satisfaction surveys (CSAT).

Types of customer satisfaction survey questions

When building your customer satisfaction survey questions, the type of question you choose to ask can make a big difference to the insights you receive and your ability to improve the experience.

Here are the types and some sample customer satisfaction (CSAT) questions to help you decide which will get you the answers you’re looking for.

Likert scale questions

A Likert Scale question provides customers with options for their response from one extreme to another (i.e. satisfied to unsatisfied), with or without a neutral response.

For example, a five-point Likert scale question might look like this:

How satisfied are you with our service?

- Very satisfied

- Moderately satisfied

- Neither satisfied nor dissatisfied

- Moderately dissatisfied

- Very dissatisfied

An even Likert scale question removes the middle response to provide a binary choice.

How satisfied are you with our service?

- Very satisfied

- Moderately satisfied

- Moderately dissatisfied

- Very dissatisfied

These types of customer satisfaction survey questions are simple to understand and answer, and will provide you with quantifiable customer satisfaction data.

However, the real attitude of your customers can’t usually be deduced by just this type of question alone. Customers might have specific drivers that aren’t highlighted by this question, or they might feel reluctant to choose an “extreme” option, even if it is true for their experience.

Binary questions

Binary questions provide you with the quickest response to any feedback survey question. By asking a simple yes/no question (or its equivalent), you can get the general sense of whether customers’ needs have been met.

For example, you could ask:

Were you satisfied with your experience with us?

[Smiley face/Unhappy face]

Did you find what you were looking for today?

[Yes/No]

Again, this does not provide you with the full context of their answer.

Multiple choice questions

Multiple choice questions can enable you to find out more about customers and their experiences.

For example, you could ask:

Which of our services was most useful for you today?

[Service A]

[Service B]

[Service C]

This type of question can be more leading for your customers, as you are providing the text answers for them to choose from. However, it can offer you more insight than a simple binary or Likert scale question.

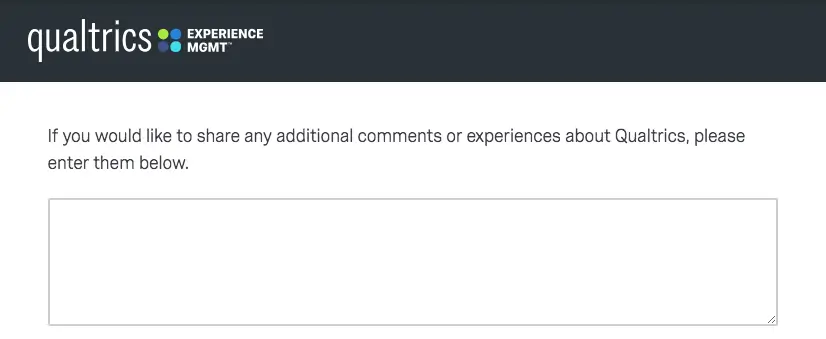

Open-ended questions

This type of question allows your customer to provide a description in their own words of how satisfied they are with your products or services.

For example, you could ask:

What could we have improved on today?

[Open text box]

Open-ended questions can give you a much more specific insight into a particular customer’s problems or highlights. However, they are also higher effort for your customers – which may put them off responding.

Get started with our free Customer Satisfaction Survey template

Additional questions to ask in your customer satisfaction survey

Adding additional questions can help you sort through and take action on your customer feedback — just remember that shorter is generally better when it comes to survey completion rate.

Usage frequency

Edit the usage frequency options below so that they are relevant to your industry or product. This helps you understand the user’s skill level with your product/service.

- Daily

- Weekly

- Once a Month

- Every 2-3 Months

- 2-3 Times a Month

- Do Not Use

Product and usage survey questions

Product and usage survey questions can give you greater insight into how your customer base uses your products and services. Not only that, but you can learn more about how they feel about them as well. This can help inform not only how you approach customers, but also with your product development efforts. Incorporating customer feedback about your products, you know how to better meet their needs and improve their experience.

Product and usage survey questions you could ask include:

- How often do you use our products/services?

- Which key features of our products/our services are the most useful?

- How easy do you find our products/our services to use?

- Do our products/services provide value for money?

- Are there any features that you would like to see in our products/services?

- What problem are you trying to solve by using our products/our services?

Demographic Questions

Demographic questions can be helpful in understanding what audiences or customer segments you are excelling with or under serving. We recommend getting as much of this data from your customer database or CRM, instead of asking for it in a survey whenever possible. Below are some potential demographic questions you can add to your customer satisfaction survey.

- Age

- Gender

- Education

- Employment Status

- Household Income

- Marital Status

- Children/dependents

- Location (zip code)

- Ethnic background

Psychographic survey questions

Unlike demographic survey questions, psychographic survey questions are more focused on psychological criteria. These questions can cover activities, interests and opinions, giving you a fuller picture of your customer profile. These questions can be open-ended, binary or multiple choice.

Psychographic questions might cover:

- Attitudes toward a certain product or service

- Religious beliefs

- Political affiliations

- Likes and dislikes towards certain topics

- Personal reasons behind purchases

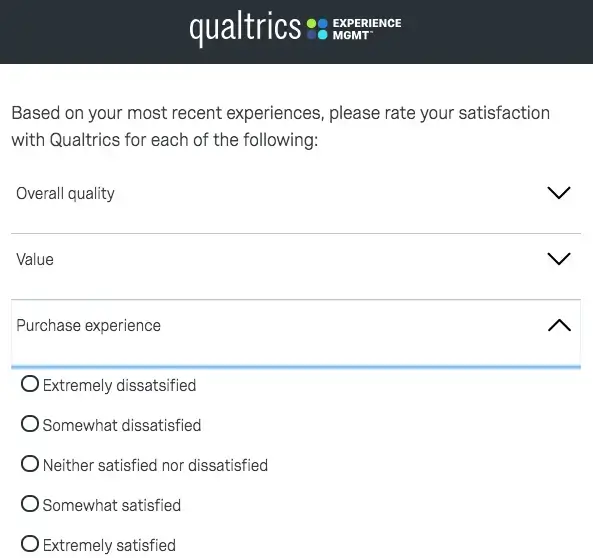

Satisfaction category questions

This type of question helps you identify satisfaction key drivers and highlight the areas of a customer’s experience that are important, allowing you to align product and service priorities. Below are potential categories of drivers.

- Overall Quality

- Value

- Purchase Experience

- Installation/Onboarding

- Warranty/Repair Experience

Open text feedback question

This question allows customers to provide unsolicited open-text feedback and their response to your customer satisfaction survey and mention specific topics or experiences for your team to review.

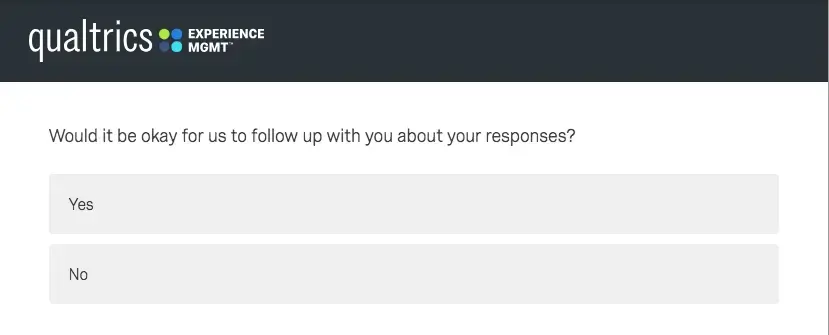

Action/ follow-up questions

This is a simple question asking if it’s okay if a member of the team reaches out to the respondent to try and understand and resolve any pain points.

Customer satisfaction survey design best practices

Properly constructed customer satisfaction surveys and questionnaires provide the insights that are the foundation for benchmarking customer happiness. Depending on what customer metrics you intend to use, it will determine what type of survey questions you need to ask your customers. Below are a few best practices:

Do

- Ask for overall company rating first– This satisfaction survey question gives you great initial insight and allows you to compare to industry and internal benchmarks over time.

- Allow for open text feedback– Open text questions allow you to collect open-ended responses from your respondents. You can gain more detail about your customer’s experiences and you might uncover new insights you didn’t expect.

- Optimize for mobile– Many consumers are now completing surveys on mobile devices or within mobile apps, so your survey must be optimized for mobile devices. If it is too complicated for a mobile respondent, survey participation will decrease.

Don’t

- Ask double-barrel questions– These questions touch on more than one issue, but only allow for one response. They are confusing for the respondent, and you’ll get skewed data because you don’t know which question the respondent is answering.

- Make the survey too long– The majority of CSAT surveys should be less than 10 questions. People won’t finish long surveys.

- Use internal or industry jargon- Your customers must be able to clearly understand each question without hesitation and using internal or industry jargon is confusing to respondents.

Linking customer satisfaction surveys to your customer journey

Asking your customers about their experiences at any time might seem useful, but ideally you will link your customer satisfaction survey to specific points in the customer journey. Proper timing of customer satisfaction surveys depends on the type of product or service provided, the type and number of customers served, the longevity and frequency of customer/supplier interactions, and the intended use of the results.

Nevertheless, timing when to send a customer satisfaction survey is extremely important no matter the circumstances.

Best practices include:

- Asking for responses shortly after the customer journey touchpoint has occurred: The experience should be fresh in your respondent’s mind so you get the most honest answers and gain insights that are accurate.

- Use multiple channels to give customers options they’ll prefer: You can solicit feedback face-to-face when they leave your store, email, online survey, phone, or within your mobile app.

- Avoid survey fatigue: Don’t quiz the same customers again and again throughout all the points of their journey – figure out when delivering a survey will give you the most useful insights.

- Take action once you have customer satisfaction data: There’s no use learning that part of your journey puts off your customers and then leaving the problem to fester. Take action to make changes once you know what experiences make customers feel less satisfied.

Delivering customer satisfaction surveys at the right points in the journey

Let’s look at an example of a customer journey from the airline industry. A customer satisfaction survey can be sent at every touchpoint in the process.

- After the customer books their flight– Feedback after the initial purchase is important because you want to understand if the person was satisfied with their checkout or purchase experience. Send an email with a link to an online survey after the customer purchases their flight to find out how satisfied they were with the booking process. Consumers want easy transactions, so look for ease-of-use in your data.

- After the actual flight– Post-purchase evaluations reflect the satisfaction of the individual customer at the time of product or service delivery (or shortly thereafter). This can be a transactional NPS or customer satisfaction survey and sent by email.

- After a customer service encounter- If the customer initiates contact with a customer service representative, a customer effort score (CES) survey should be sent immediately after the issue was resolved. For airlines, this could be a call to change a flight date or report lost baggage. The goal is to see how much effort it took to resolve the issue.

- Six months after the flight– To measure the long-term customer loyalty, relational NPS or CSAT surveys can be sent months after the transaction occurred to see if your customers are still loyal to your brand.

- In-app mobile feedback– You can request customer feedback on the mobile app or customer experience through a feedback tab in the app. Getting mobile app feedback is important — only your customers can tell you what will make them more satisfied with their experience.

How to turn your customer feedback into action

Measuring customer satisfaction is important but what you do with the data is essential. If your customers take the time to fill out a survey, it’s important they know you’re serious about improving their experience.

- Close the loop– Respond quickly after receiving negative feedback from your customers. This is a chance to keep your customer loyal. 70 percent of consumers said they would be more likely to do business with an organization again if their complaint was handled well the first time.

- Analyze for trends– Understand what metrics you’re looking to improve and see if there are patterns on these specific items. For instance, if 30 percent of respondents say the customer service wait time was too long, you know you need to improve in that area.

- Company-wide effort- Every department must be on board to keep the customer satisfied. If customers complain about a product feature, the product department must be willing to receive the data and fix it. If customers complain about the service, customer service representatives need to understand how to fix the issues more effectively. Make sure the right people have the right visibility with role-based CX dashboards and analytics.

Customer satisfaction survey templates

Do you want to go deeper into customer insights and create loyal and satisfied customers?

Though looking at customer satisfaction survey examples is helpful, we’ve gone one step further to create a customer satisfaction survey template to get you started.

Our prebuilt customer satisfaction survey template can be used in your customer experience management (CXM) to start properly measuring customer satisfaction. Keep in mind, all of these customer satisfaction surveys can be used today when you sign up for a FREE Qualtrics account.

Other Customer Feedback Resources:

- Customer Feedback – What to Collect and When

- Omni Channel Customer Feedback

- How to increase survey response rates

Get started with our free customer satisfaction survey template