Market research has quickly become the star player for brands and businesses around the globe, netting them the insights they need, right when they need them.

From understanding industry challenges and future trends to customer satisfaction and product performance, market research is paving the way for organisations and empowering them to create content, products, services, and offers that truly resonate.

And it all starts with one thing: primary research. A research methodology that enables researchers to uncover and answer specific questions about issues, challenges, trends, or otherwise.

In this guide, we’re going to cover everything you need to know about primary research and how you can use it to benefit your business.

What is primary research?

Put simply, primary research is any type of research you collect yourself or commission on your behalf. This could be anything from surveys and interviews to observations and ethnographic research (studying participants in their real-life environment).

Most researchers will use primary research to supplement data from secondary sources, such as journals, magazines, website articles, and books. By using primary research methods alongside secondary research, researchers can validate and support their findings with additional, new data.

You don’t have to be an expert to conduct primary research or collect data from it — chances are you’ve done some of it already. Think back to when you may have been asked to carry out a project at school. If you did the research (or asked mom or dad), e.g. interviewing experts, and using data from journals, you’ve collected and used both primary and secondary data.

That example might be a little simplistic, but the concept still applies. There are, of course, plenty of methods to choose from, so understanding what they are and how they work will help you execute research campaigns.

Now, when you conduct primary research, you typically gather two basic types of information:

- Exploratory. This research is general and open-ended. It typically involves lengthy interviews with individuals or a specific group.

- Specific. This research is more precise and problem-oriented. It involves structured, formal interviews.

Then there’s the question of qualitative research and quantitative research; what kind of data do you want to capture? Do you want to understand the emotions and behaviours behind people’s actions or to put precise figures against certain issues? Another thing to consider.

In the next section, we’re going to go through the types of primary research methods, the advantages of primary research, and then how you can do it for your brand or business.

What are the types of primary research methods?

There are lots of different ways to carry out primary research, more notable methods are interviews and surveys — but what about observations, analyses, and focus groups?

Interviews

We’re all familiar with interviews. This research method usually involves one-on-one or small group sessions, conducted over the phone or in a face-to-face environment. Interviews are great for collecting large amounts of data from a small sample of subjects, or when specific information needs to be extracted from experts.

For example, for a piece on developing more sustainable energy sources, a journalist would choose to interview a subject matter expert to extract the primary research they need. Not only is the information more authoritative and accurate, but it’s also more compelling.

Be aware though, direct interaction can alter people’s opinions. For interviews and focus groups, it’s best to get an expert to manage and read the room to avoid skewing results.

Surveys

Another industry staple. Though much more rigid compared to interviews (with predefined questions and themes), surveys are a great way to reach a target market and collect relevant data at scale. Surveys will typically provide a limited amount of information from a large group of people (as there are only so many questions you can ask before respondents get bored).

To get the most value out of surveys, it’s worth defining your audience and questions well in advance. Try to think of key themes that you want to explore and what you want to get out of the data collected.

For example, a supermarket might send out a survey to their customers on customer satisfaction, asking questions about the overall in-store experience, the online experience, what customers would like to see, and more. Because it’s issued at scale, the supermarket can get a good understanding of what their larger customer base thinks.

Observations

While it might be the most arduous form of field research, observation is arguably the most impartial as there’s no interaction between the researcher and the subject. As such, this approach removes or reduces bias that could be encountered during an interview or survey, as the subject’s actions are not influenced by other factors.

For instance, a sports car manufacturer might want to see how their vehicles are used in real-world scenarios and if there are any limitations on the customer. This could be a case of visiting a race track or car showroom to see how customers use the vehicles.

Focus groups

This method is great for gathering data on particular topic areas. Sitting between interviews and surveys, focus groups allow you to engage a small group of people, e.g. subject matter experts.

More informal than interviews but more professional than surveys, they’re a great way to gain insight and valuable information on customers, pain points, and other areas of interest in your industry.

For example, a technology manufacturer might put together a focus group to discuss technology adoption amongst 24-36-year-olds ahead of a new product launch. Through this focus group, they can learn more about how 24-36-year-olds purchase and engage with new tech solutions.

Research services

While the process of gathering data is relatively straightforward, making sense of it (and having the right skills to turn it into insight) can be tough.

This is precisely why so many brands and businesses turn to research services. According to our data, 97% of market research is outsourced. This allows brands and businesses to gain access to relevant information for truly original research.

Though a more modern form (and approach) to primary research, research services enable brands and businesses to collect data and analyse it very quickly. But the main benefit? Expertise.

With research services you get a team of experts who know exactly what research questions to ask and how to turn survey responses into actionable insight. They know how to get the right respondents and the ideal sample sizes, as well as leverage primary research and secondary research data to build comprehensive, revealing reports.

| Type | Pros | Cons |

|---|---|---|

| Interviews |

|

|

| Surveys |

|

|

| Observations |

|

|

| Focus Groups |

|

|

| Research Services |

|

|

What are the advantages of primary research?

Now you know about the main ways to collect data, what are the benefits of these primary research methods?

First and foremost, and perhaps most importantly, primary research delivers accurate, relevant, and up-to-date information, enabling you to identify emerging trends in customer behaviour, discover unmet needs, and close gaps across the experience journey. There’s real value in being able to identify what comes next — and only primary research can give you a real-time view of what your prospects and customers need as the world changes around them.

Also, as you have full control of the approach, data collection and analysis, it can be far more efficient and cost-effective than others.

Lastly, the information belongs to you or your organisation. You may choose to release the information to enhance your position in your market or industry or keep it private to avoid giving competitors an advantage.

Create better experiences

From a customer perspective, it offers many advantages and provides detailed information on how you can improve products, services, and experiences. By taking their market surveys in-house and using the Qualtrics XM Platform™, Samsung collects, analyses, and acts on insights gathered at every touchpoint. The team at Samsung can get studies up and running in an hour and quickly implement findings to transform their product, service, and customer experiences.

Develop engaging content

From a content perspective, this kind of first-hand data offers a plethora of opportunities. You can begin to create trend reports, answer the most pertinent prospect and customer questions, highlight key issues, and much more. Every voice matters and ensuring your research is inclusive is vital.

What are the disadvantages of primary research?

Costs can potentially spiral out of control if you feel that your results are inconclusive or that you want to change the data gathering method.

It can also be time-consuming, especially if you require a large sample size or don’t have the in-house expertise for the analysis. Data gathering is one thing — drawing insights and formulating conclusions is another. The time required to effectively plan, carry out, and scrutinise the data is often greater than the time it takes to conduct secondary research.

Lastly, accuracy. You have to account for potential bias — skewing the results — and poorly worded questions. There are ways to eliminate bias from your surveys, such as:

- including more open-ended questions

- making respondents feel comfortable

- using both qualitative and quantitative techniques

- using an impartial way to gather data

Primary vs secondary market research

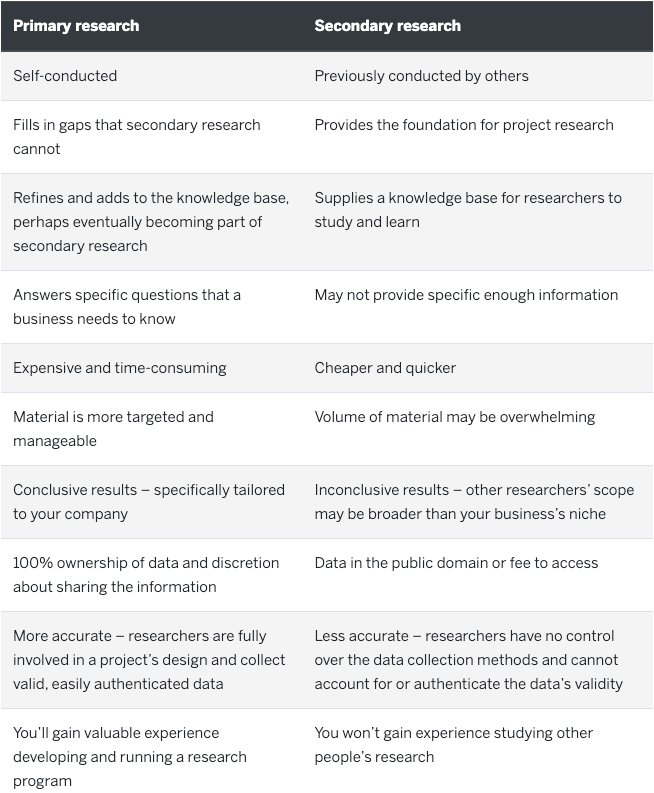

The key difference between them is that you collect primary research first hand (often for a specific purpose, e.g. a trends report), while secondary research comes from pre-existing studies, materials, websites, or articles.

Secondary research methods are more about desk research. You scour reputable journals, articles, websites, and studies to find the information you need to either support a point or build your project around.

Most market research will start with secondary research to understand what the issues are or what prospects and customers are searching for online. This could be using Google Analytics to identify the key issues and trends in 2021 and then using primary research to get more information and delve deeper into them.

We would urge you to look at the primary vs secondary research debate a different way: both can be used in conjunction to support and validate points. Incorporating high-quality secondary research data into your reports can provide wider perspectives and show readers that your thoughts don’t exist in a vacuum.

Find out more about primary vs secondary research

How can businesses use primary research?

Competitor analysis. Trend reporting. Customer satisfaction. There’s no limit to the uses of primary research for businesses, particularly now as it becomes more difficult to gather information from prospects and customers.

One of the most effective ways to use primary research is for industry analysis and content campaigns. Let’s say you produce a report on current trends in automotive. From the data, you find that the key concerns for automotive manufacturers are:

- The skills gap and need for new technologies to support production

- Sustainability and shifting operations rapidly

- Supply chain efficiency and utilising a dual supply chain (local and global)

- Customer demand and expectations of new-age vehicles

Now not only do these concerns make for great headlines, but you can also build entire campaigns around the data you find. Suddenly, rather than just one report sharing information and not making real use of the insight, you can create blogs, ebooks, webinars, opinion articles, commentary, and much more.

Primary research is the gift that keeps on giving — and that’s precisely why more and more organisations are creating annual reports on the state of their industry or market.

As well as providing unique insight and content campaign opportunities, primary research establishes credibility… and very quickly. If you produce an annual report and none of your competitors are doing the same (or their reports lack the granularity and focus your prospects and customers require), you demonstrate expertise and become the go-to for real insight.

How can primary research support marketing?

As the gift that keeps on giving, primary research lays a foundation for marketing campaigns and long-term strategy.

Most research is top-of-the-funnel (TOFU) — or at least designed to be as such. Market research reports are inherently about raising awareness of an issue or problem — that’s where businesses can extract the most value.

For your marketing team, the issues raised in the report can become the headlines for blogs and commentary. They can then create content to help readers solve those issues, referencing what your business does in the process (but only if it’s relevant). Finally, marketing can steer readers of the report content towards other assets of interest, gradually nurturing readers to a point that they’re sales-ready.

Here are just a few things you can get out of primary research reports:

- Blogs

- eBooks

- Opinion articles

- Sales collateral

- Infographics

- Executive summary reports per industry

Conducting primary research

Getting started with primary research is simple thanks to the tools and software available today, and most of the time it starts with a simple online survey.

No matter what research you want to conduct, there are survey solutions and templates to meet your needs.

But before we go into the technicalities, let’s focus on the fundamentals of conducting research:

- Have a subject in mind. What issues do you want to cover?

- Validate that subject based on secondary research. What are people searching for or need answers to?

- Draft a research question (or problem statement) and revise as necessary. What will be your main question or the purpose of the study?

- Agree on the goals and objectives of the project. What do you hope to achieve?

- Create a timeline and set deadlines. Is everyone aligned?

- Choose your research methods and tools (e.g. face-to-face interviews or online surveys). What’s the best way to get the information you need?

- Work out your ideal sample size (smaller or larger population?).

- Think qualitative or quantitative (a mixture of both generally works well). Do you want to know the reason behind responses or just get conclusive numerical data?

- Develop a questionnaire and have it peer-reviewed. Are your questions as good as they can be and do they support your problem statement?

- Test your questionnaire. What better way to ensure that it works and delivers the right insight?

- Select a delivery method. How do you want to distribute your questionnaire? Online? Offline?

- Analyse the results. Do you have the right tools, skills, and resources to glean insights from the data you receive?

This is certainly a condensed structure for conducting primary research, but it should work nonetheless. The main thing is starting the right way — have the right subject in mind and validate it.

Recent research trumps everything else

When you have the means to conduct research frequently and at scale, the more recent or ‘fresh’ it is, the more valuable the insights.

Of course, not every brand or business is in a position to undertake primary or even secondary market research every year. This could be due to budgetary constraints, poor insights from previous research, or a lack of in-house expertise.

But regardless of the issue, the power of primary research is well-documented and apparent, and it gives you the means to create profound and compelling content for your target audience.

Start your next research project the right way

If any of the above issues sound familiar, we can help. At Qualtrics, we specialise in market research and gleaning insights from data to create breakthrough experiences. From designing your study and finding respondents, to fielding it and reporting the results — we can help you every step of the way.

As well as that, we know how you can get more ROI from your market research and have put together a simple guide to show you.

In this guide, discover how you can:

- Improve ROI through speed, agility, and consolidation of your research functions

- Get insights faster without sacrificing data quality

- Adjust how you conduct research to be more nimble

Download your copy for free using the button below.

eBook: Maximise your research ROI