The importance of getting survey distribution right

You’ve put a lot of thought into your research survey and strategy. You might have planned the survey questions already, segmented your target market and have secured the budget to carry it out.

But before you move forward, make sure you have the right survey distribution methods. Ideally, it’s best to have the distribution methods worked out at the start, so you can align your survey questions, sample size and options to make the most of your preferred method’s benefits.

Ultimately, your business is conducting survey research to help solve a problem, such as ‘how will potential customers engage with the product or service?’.

Yet, at the same time, the survey participants must also want to respond and engage with the questions, which can be hindered by a lack of time, poor survey design or not understanding the intended uses of their data.

Get started with our free survey software

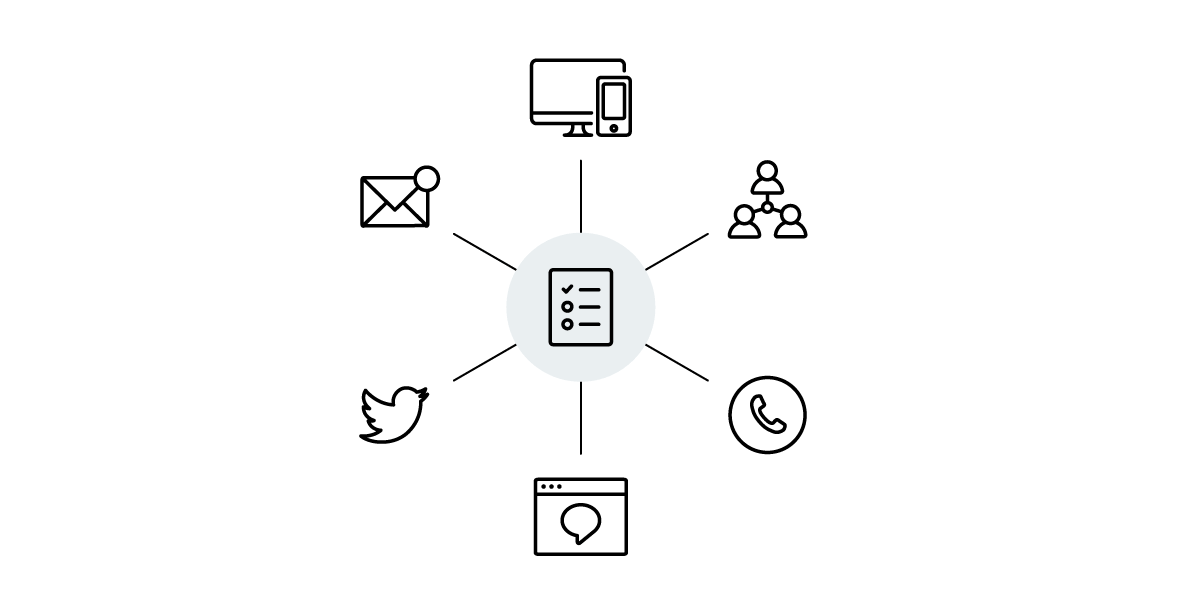

Survey distribution methods in detail

Let’s explore the ways that surveys can be distributed. By comparing the options available, you can explore which survey distribution model would work best for your next research project.

The most common way is to distribute your survey as a link, created by using an integrated survey platform. The core benefit of this is that the data collection and analysis can be turned around quickly through the same platform you use to send your survey.

For some of the methods below, like in phone and in person interviews, the delivery of the survey is done manually, with responses uploaded or input after the event, ready to be analysed. This can take a lot more time as there is a lot of information to collect and sort through, though there are benefits to these methods.

If you choose an email as your distribution method for sending out your survey, traditionally, your survey is linked in the email using a hyperlink.

Follow email best practices with an engaging subject line, keep the email short, and be clear on what you want the recipient to do (usually, ‘take the survey’’!) in your call to action.

Pros

- This method is quite easy to carry out using all email platform services. If you are mass emailing the survey to lots of addresses, you can add personalisation to the emails by doing a mail merge to save time. A mail merge contains data fields in the body of your email, which populates itself from data in a linked spreadsheet or database.

- An email gives you an opportunity to connect with participants, introduce the purpose of the survey and include supporting information that you would like the participant to know ahead of taking the survey.

- The email can be accessed by any device that has access to email, including smart devices, personal mobiles and laptops. This method is not limited by geography or time-zones.

- Email recipients can reach out to connect with the research team if they have any questions, which aids understanding and confidence in carrying out the survey.

Cons

- The email with the survey link can be lost in inboxes and reminder emails may need to be sent following the first email. This will help pick up more click-throughs from people who missed the link the first time round.

- In some parts of the world, sending unsolicited emails to target customer segments can breach data security rules. For example, GDPR law is active across Europe. Make sure to check whether you’re able to contact people legitimately by reviewing relevant legislation ahead of time.

- Email marketing lists need to be kept up to date, and the members should be able to ‘opt out’ of the list if they want to. A clear data collection strategy should be supplied along with the email, to let readers know their rights about privacy and data management.

Social media

When you want to bring your survey to a wide, non-specific audience, social media is a great route to take.

Depending on the platform used, you may need to creatively think about how to market your survey. This could be by creating a promotional image to share, sending out an alert on micro-blogging sites or recommending the survey to particular people. You can also look at survey incentives as a way to encourage people to take the survey.

You can share the link to the survey directly from the social media post, or a link to a website where more information and the survey link can be found.

Pros

- If you have a social media channel that has a lot of followers or subscribers, you can reach out to them for free. As the registered members are more likely to support and approve of your brand, they are more likely to be interested in hearing about your news, and so will pay attention when something new is launched.

- Social posts can further be targeted by tagging the message with specific hashtags or topics, which help target people with similar interests. This can mean that non-followers or non-members can also find the survey message easily.

- Paid social media promotions enable you to target specific audiences and segments for when you don’t have a large following or want to reach a new target audience.

- The message space for social media posts can be limited by character constraints, so key messages must be short and compelling. If you’d like to do a longer introduction at the same time as supplying the survey link, you’ll need to add a first page to your survey explaining more to participants or provide a link to a webpage in your posts.

- If the survey link connects to a survey that has been created using an integrated survey platform, collection and analysing results can be turned around quickly through the in-built automation.

- This method is not limited by geography or time-zones.

Cons

- There are a lot of social media posts to contend with. You may need to spend money on promoting your social media posts to gain more viewers, which could add project costs.

- Unless there is clear information when viewers click the link, viewers may want to find more information. If viewers want to get back in touch through social media, the research team may need to collaborate with social media managers or administrators to set up a process for feedback and enquiries. This process may take time to set up and carry out each time there is a direct query back.

SMS

Sending a survey link as an SMS (Short Message Service, i.e. text message) directly to participants can be a highly effective way of being noticed, leading to open rates as high as 98% compared to only 20% for emails.

Getting phone numbers can be hard to do for target customers, unless you already have a substantial customer database to lean on. SMS messages will be most effective where the recipient knows and trusts the sender. For example, someone is more likely to engage with an SMS survey sent by their employer than a brand they have never heard of before. As such, sending unsolicited SMS messages can be difficult to achieve good response rates.

Pros

- Since a lot of other social and work activities happen through SMS and notifications, your survey will gain immediate attention.

- The message space for SMS can be limited by character constraints, so key messages must be short and compelling. If you’d like to do a longer introduction at the same time as supplying the survey link, this may not be the right method for you.

- If the survey link connects to a survey that has been created using an integrated survey platform, collection and analysing results can be turned around quickly through the in-built automation.

- This method is not limited by geography or time-zones.

Cons

- Your message could be considered spam, especially if the number is not linked to an existing contact. It’s important to be very clear in the message who the sender is and why you’ve been contacted.

- SMS marketing lists need to be kept up to date, and the members should be able to ‘opt out’ of the list if they want to. A clear data collection strategy should be supplied along with the SMS, to let readers know their rights about privacy and data management.

- Unlike social media basic posts, SMS text messages cost the organisation money to arrange and send out. Costs will be dependent on the service used and the frequency of messages.

Digital workspaces (Slack, Microsoft Teams)

If you’re invited to be part of a digital workspace, either as an employee or an external member, the inviting organisation may use this as a key channel for distributing communications and internal research surveys.

Collaboration tools like Slack, Microsoft Teams and Sharepoint provide user-friendly and easy ways to distribute links across a network, since a lot of people are already signed up to the channel.

Pros

- Some digital workplaces have in-built survey software or polling that enables smaller and shorter surveys. For larger surveys, sending a link through a digital workspace can be useful for employee or internal company surveys.

- This type of service is often integrated into other systems and has spaces dedicated to specific teams or projects. If you’re looking to narrow down the participants you’d like to this granular detail, there are ways to mention or tag teams according to the survey announcement.

- If the survey link connects to a survey that has been created using an integrated survey platform, collecting and analysing results can be turned around quickly through the in-built automation.

Cons

- Some software used for work in companies has controlled or closed security measures that prevent external access. This can make it problematic to share a survey widely to third-parties, and can limit who you can connect with.

- If you would like to target wider audiences outside of employees or closed networks, it might be better to use another method of distribution that gives more flexibility and options.

In-app

Brands with their own apps can use this digital channel as a way to listen at key customer touchpoints along their journeys.

This distribution method can use random device engagement (RDE), which is asking for survey participation in exchange for an incentive that aligns with the channel’s ethos. For example, a beauty tip app can provide access to premium or locked beauty tips in exchange for completing the survey.

Alternatively, the app can be seen as a channel similar to a brand’s website, and the survey link can be shared through the channel through a pop-up or an appropriately positioned message.

Pros

- RDE can enhance a user’s experience of the app, as they are receiving an additional extra in exchange for their time and insights. This can be seen as a bonus as no money needs to exchange hands, and can increase response rates.

- Apps are naturally mobile-friendly, so anyone who downloads the app can have access to the survey.

- One of the most appropriate uses of surveys distributed via apps, would be to gather UX feedback on the app itself — being able to send it in the moment of the user having the experience can help you get much higher quality data.

Cons

- Your survey participants will be limited to the people that use the app. If you are looking to broaden your research to new consumer segments and audiences, you may need to mobile in-app surveys with other distribution methods like website, social media, and email surveys.

- Participants may not take the survey seriously and answer questions as quickly as possible in order to get the bonus incentive.

- The random nature of RDE is not targeted to specific users, so results from the survey questions will not have associated demographics that can be used to segment the data.

QR code

A QR code (Quick Response Code) is a matrix barcode that can be printed on various media, like receipts and posters, or scanned from an online graphic in a PNG image format.

When your survey’s QR code is scanned, respondents will be immediately directed to your survey. QR codes do not track information identifying your respondents.

Pros

- If you have a long link to your survey or if you want to capture details in one click, a QR code can save your participants time. For example, at events, this would be a static image code available for all to capture, without the need to wait or stop to take down details.

- QR codes are easy and free to use. They are easy to create through QR code generators, and most mobile devices can scan QR codes through free downloaded apps.

- QR codes do not expire, so it can be used for long-term feedback that is not bound by specific events or timeframes.

Cons

- Survey participants must opt in to take the survey, and capture the QR code to begin. The supporting content around the QR code must be persuasive for participants to make this extra effort.

- Since this is newer technology, older generations of participants may find using this method confusing or need instructions on how to scan the codes. It may be less confusing to use a traditional form of survey distribution like email, which provides access to the survey clearly as a hyperlink.

Website pop ups/intercepts

If your brand has a very active website, it may be a great place to share survey questions. Customers or shoppers will see the questions as opportunities to provide feedback, and are likely to answer one or two questions as they go along.

Pros

- This survey distribution channel takes advantage of visitors that are already interested in, and know the brand. The survey could be tied into a particular page about a product, which can also make any feedback received specific to this item.

- Since cookies and website metrics can be combined with the survey answers, researchers can see what the customer’s behaviour was compared with how they answered the questions. This gives a bigger picture of what’s going on. The cookies can also target when best to send the pop up surveys, based on the volume of customers online at any one time.

- Surveys can be triggered by user events, such as when someone clicks away from a webpage, to enable you to get feedback users exhibiting specific behaviours such as cart abandonment surveys.

Cons

- Given the way that IP addresses are stored and protected under data security regulations, researchers may not be able to gain personal details of visitors in some regions.

- Pop-ups can be seen as annoying, so people might ignore them, or find they get in the way of them completing their primary task such as completing checkout. Make sure you’re strategic in your use of pop-up style surveys, and ensure you have limits on how many times a single user can be invited to take a survey.

Use a panel

This is a traditional channel for researchers and marketers to use. Companies will pay for their surveys to go to participants that are pre-approved as part of the service, who all conform to the target market’s background. In this way, respondents represent the right market and their responses are given more weighting.

Pros

- There are a wide variety of respondents for researchers to choose from, and you can be as specific as possible on the respondent profiles.

- The costs for this service are reasonable and panels form a traditional route when time is limited or researchers are struggling to find their own sample such as through their own customer database or from their social media followers.

Cons

- There can be a lack of transparency about respondents hired through third-party services. They may be incentivised to finish surveys quickly or may not be suitable on closer inspection, which could impact the quality of the results received. Make sure your panel provider includes data quality checks to ensure you weed out these poor responses, and don’t pay for data that’s not useful to you.

Over the phone

In this survey distribution method, researchers will arrange times to speak to participants and either run through questions together while the answers are recorded, or the researcher will read out survey questions and fill in an online survey on behalf of the participant.

Pros

- As this method of survey distribution is real-time, the researcher can follow-up on questions with further enquiries at the time. This can lead to richer data and more nuanced answers, depending on the direction of the conversation.

- A telephone conversation can start building a rapport through the interactions between the two people.

- This survey distribution method might work best with a small to medium number of participants, so that the research can be conducted over a set period of time.

Cons

- The administration to carry out a phone survey will take up a lot of time and effort.

- Phone surveys can cost more money to the research organisation compared to an email survey or website feedback request, so you’ll need to factored these the cost of the research from the start.

- Data collected from phone interviews will often need to be transcribed and uploaded to your data collection platform in order to be analysed alongside other responses from say website or email surveys. This process can be labour intensive, unless your survey platform offers voice analytics that automatically transcribes and analyses conversations in real-time

In person

Some surveys could benefit from in person research, where participants attend a meeting individually or a focus group collectively. They are then asked questions by a researcher, and their responses are collected and analysed afterwards.

Pros

- Researchers can combine verbal and non-verbal cues to create a full picture of the participant and why they have answered in the way they have.

- This method of survey distribution can be really helpful for answering how products are used physically, or providing data on how physical products are assessed. For example, one research question could be about which items (from a group of items present in front of the participant) are more user friendly and why.

- The presence of a group of participants together can provide a shared experience for all, encouraging people to open up and share along with the group.

Cons

- Conducting interviews in person can lead to conformity bias, as participants may be influenced by the researcher and the act of being interviewed. This can also lead to biased answers, that aim to please the researcher or arrive from non-verbal cues that the researcher gives the participant.

- There can be downsides to conducting research in large groups of participants. Some may be more vocal in groups and overtake smaller voices, there could be conformity bias, or participants might find it difficult to offer disagreeing or sensitive viewpoints in public.

- Data collected from in-person interviews will need to be transcribed, uploaded, and analysed to generate insights. This process can be labour intensive, and quantifying qualitative data can be hard to do without a powerful analytics tool.

Get started with a free account

With most research projects, it’s a good idea to explore multiple distribution methods for your survey. This enables you to reach out to a wider audience, taking account of respondents’ preferences for different channels and devices.

Of course, you may favour one over another depending on the project itself – for example, UX research about your organisation’s app is best done using in-app survey rather than a panel or email as you can’t guarantee the recipients of those surveys will have experience of the app. However, a research project like product testing that requires a broad audience could take advantage of any number of the methods we’ve looked at.

When choosing how to do your research, look for a survey platform that offers multiple distribution options so you can tailor each project to get the best quality data from the sample you need.

With Qualtrics, you can gather feedback from 125+ different data sources, from phone interviews, to email surveys, QR codes, social media, apps, websites and many more.

Plus, with more than 50 templates available for the most common research projects, you’ll have best-practice research methodology baked in, too — so you know you’ll get the best quality data.

Open a free account to explore some of our survey distribution methods, check out our templates, and get started with your research project.

Get started with our free survey software