Customer Experience

Global consumer trends for 2025 revealed

Understanding what drives consumer loyalty – and what leads to churn – is crucial for any business looking to succeed in an incredibly competitive market. Here’s a snapshot of how the latest consumer trends will shape 2025.

What’s the current state of consumer experience?

Consumer behavior is always changing, but over the past few years, there have been big shifts that require businesses to reset their thinking – and turn their attention to what really matters to consumers right now.

We can see this changing tide across a couple of key traits:

Consumer spending

You probably don’t need us to tell you that times are tough. Luxury goods and necessities alike cost more than ever, and there’s less money to go around in the first place. In fact, consumer likelihood to purchase more is down 1.3 points.

But all is far from lost. Our research shows that customers will exhibit loyalty if they’re met with the right experiences.

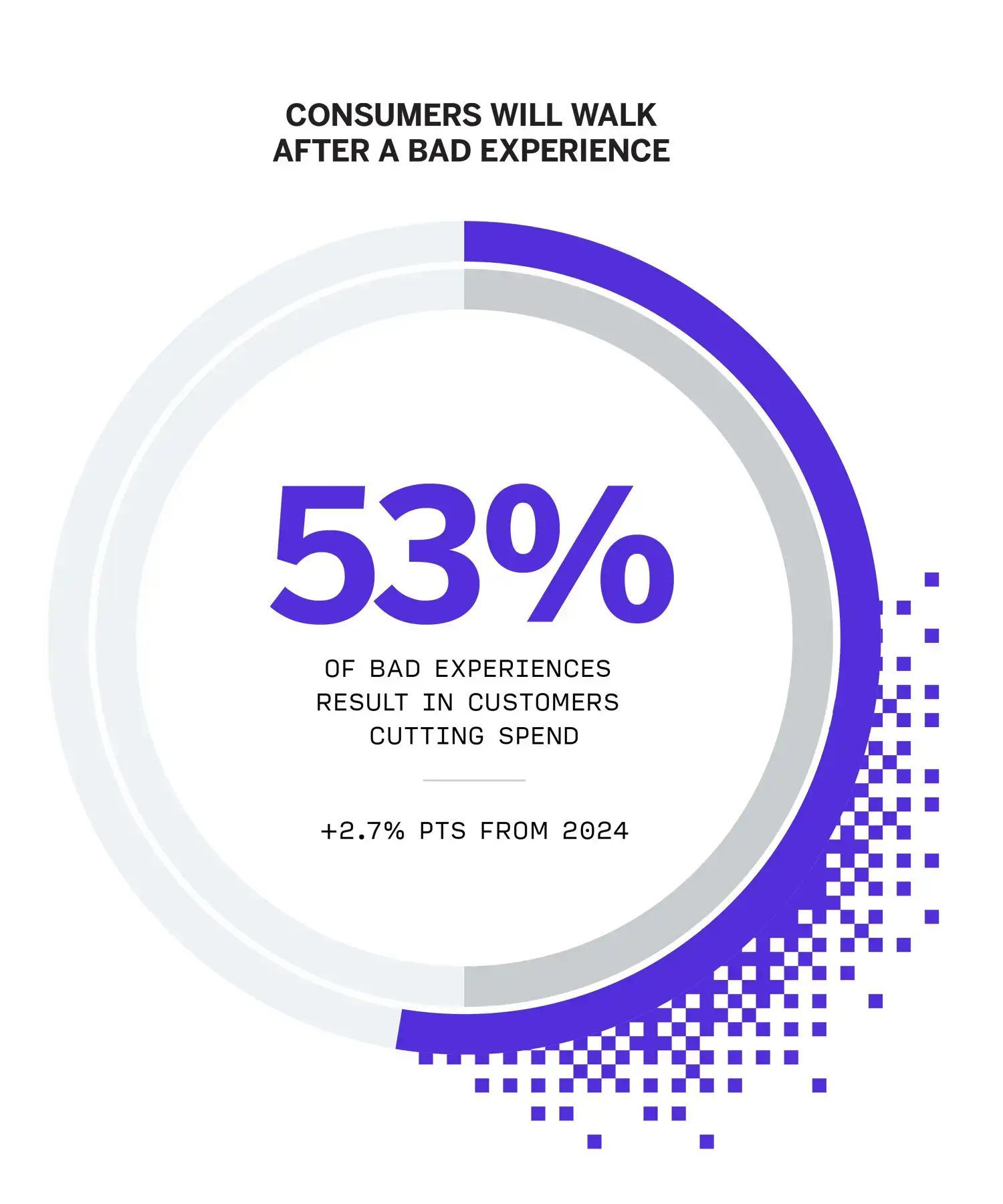

Of course, the inverse is also true. over half of bad experiences will result in a reduction in spending. Unsurprisingly, brands are starting to notice this and making efforts to raise their game – in fact, consumers recorded fewer bad experiences versus 2024.

This interplay is playing out in interesting ways. For example, because ‘nice-to-have’ brands have to fight so hard for consumer’s discretionary spend, they’re delivering fewer negative experiences across the board than industries that fall into the ‘need-to-have’ category – like banks, internet providers, and utilities.

And this is raising expectations across the board – including for “need-to-have” industries, which are no longer as immune to the consequences of a bad experience. These 'necessity’ industries still face fierce competition within their own sectors and will need to up their game to compete; our 2025 consumer behavior findings show that subpar experiences could cost them as much as 7% of their sales.

Brand loyalty

It’s harder to build loyalty when consumer spending is generally down. It’s even harder when they’re even more willing to hop from one brand to the next – but it’s not impossible.

The difference is, once again, all about the end-to-end quality of the customer experience. And in fact, the biggest brand loyalty gains actually live at the lower end of the spectrum – moving from a poor to okay customer experience.

Moving from a one or two-star experience to a three-star experience rockets consumers’ likelihood of making a repeat purchase by 68%. That’s 15 points more than the bump brands receive from moving from three stars to four or five.

What are the 2025 consumer trends?

Based on responses from 23,730 consumers surveyed across 23 countries, our Consumer Trends Report shines a light on the way customers think – and the factors that will make the most meaningful change to your bottom line.

From AI skeptcisim to ever-evolving CX expectations, we’ve sifted through the data to pick out five trends that will define the global consumer marketplace in 2025.

In our full consumer trends report, we’ll dive into each trend to pick out the priority areas that every business – in every industry around the world – needs to know.

That’s alongside highlighting the opportunities and risks ahead and providing expert advice on how to navigate the findings.

Download our 2025 Global Consumer Trends Report

Need a quick snapshot? Here’s a whistle-stop tour through the consumer trends and buying habits that will shape the next year of global commerce:

Trend 1: Heightened expectations fuel a decline in loyalty

While consumers have always wanted the brands they buy from to go the extra mile, it’s now even more important. There’s a complicated web of factors at play here, but the long and short of it is this: a tough economy makes consumer loyalty harder to earn, while poor experiences in today’s competitive landscape make customers harder to keep.

More than half (53%) of bad experiences result in customers cutting their spend. Even moving from a one or two-star experience to a three-star one can increase likelihood to buy again by a huge 68%. And that same experiential shift will also have a transformative 97% increase in their likelihood to recommend.

There’s room for improvement here at every end of the spectrum. Small, niche upstart companies, for example, must remember that they’re no longer simply competing with mom-and-pop rivals. They’re battling for consumer loyalty against highly sophisticated, ‘digital native’ online shopping and social commerce brands that employ cutting-edge CX tools to gather insights and deliver outstanding experiences.

All told, our first trend sets the tone for the rest of the year: consumers expect brands to deliver on their brand promise. Meet those climbing expectations and you’ll do what many others are struggling to do: build customer loyalty.

Trend 2: Consumers are clear – go back to basics

How are you doing on the fundamentals? Communication, service delivery, and ensuring that the information you’re providing consumers is accurate? This stuff really matters.

In an era awash with the promise of AI (and we’ll get to that in a bit), a great many consumers really just want the brands they do business with to have the basics nailed – especially if chasing trends comes at the cost of missing the mark.

Across your customer’s entire journey are moments that will make or break your relationship with them. They’re at different points for every single customer, and you have no idea how or when they’ll show up. You must create trust and cohesion across its entirety, thinking about every potential opportunity for delight, or frustration. You need to appeal and connect with customers at a deeper level than you’ve previously been reaching.

- Brandon Hanson, Qualtrics GTM Strategy + Product Marketing

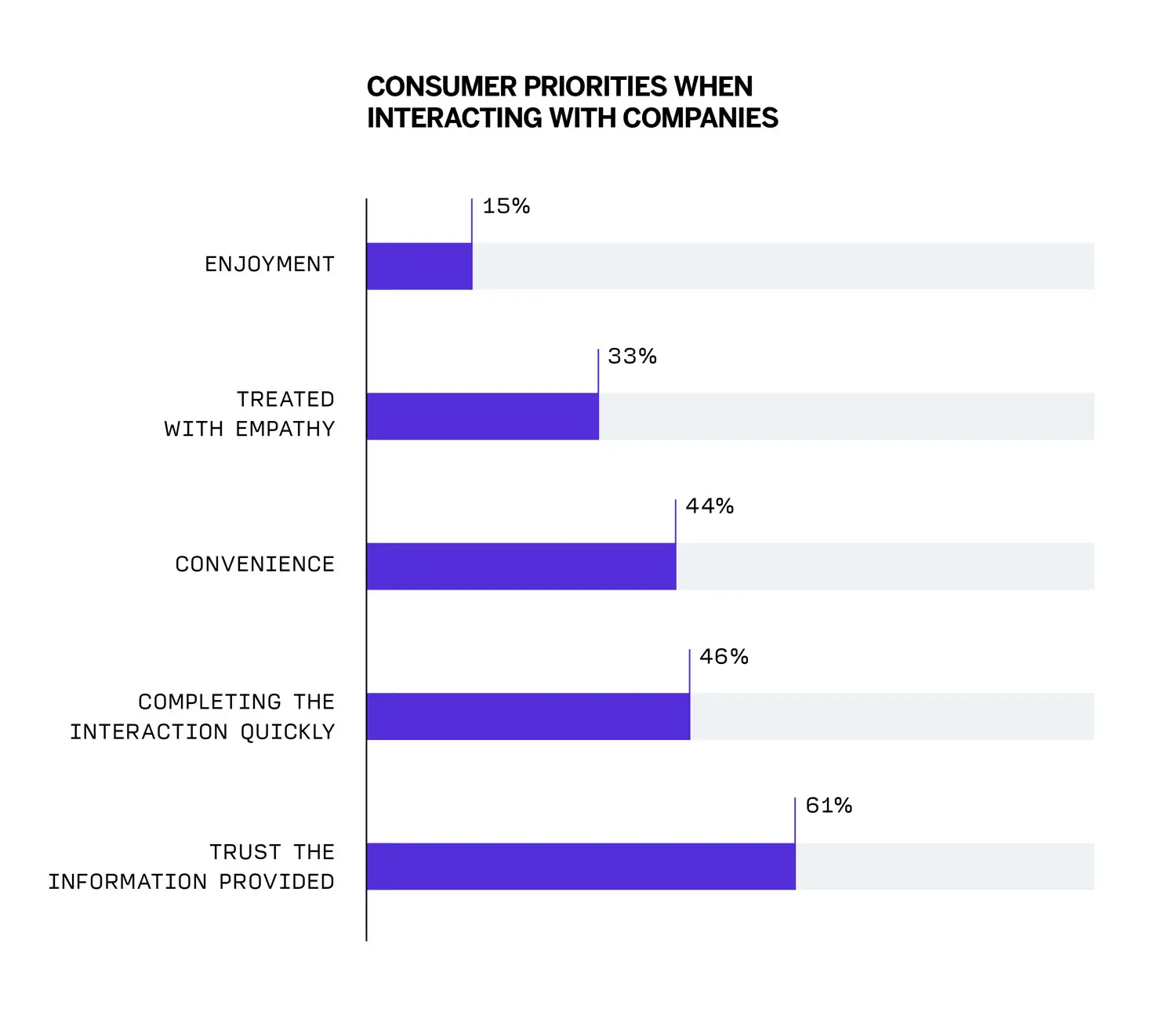

This all boils down to one core characteristic: trust. Likelihood to trust highly correlates with both increased likelihood to repurchase (0.62) and recommend (0.79), while consumers cite that their ability to trust the information you provide them is their number one priority.

The reality doesn’t always meet the expectation here. Consumers cite communication issues as the second most frequent cause of poor experiences – just behind the core fundamentals of service delivery.

Trend 3: Feedback falls to a new low

How do you know if you’re giving consumers the experiences they crave? The way we collect and analyze feedback is changing rapidly – and in ways you might not expect.

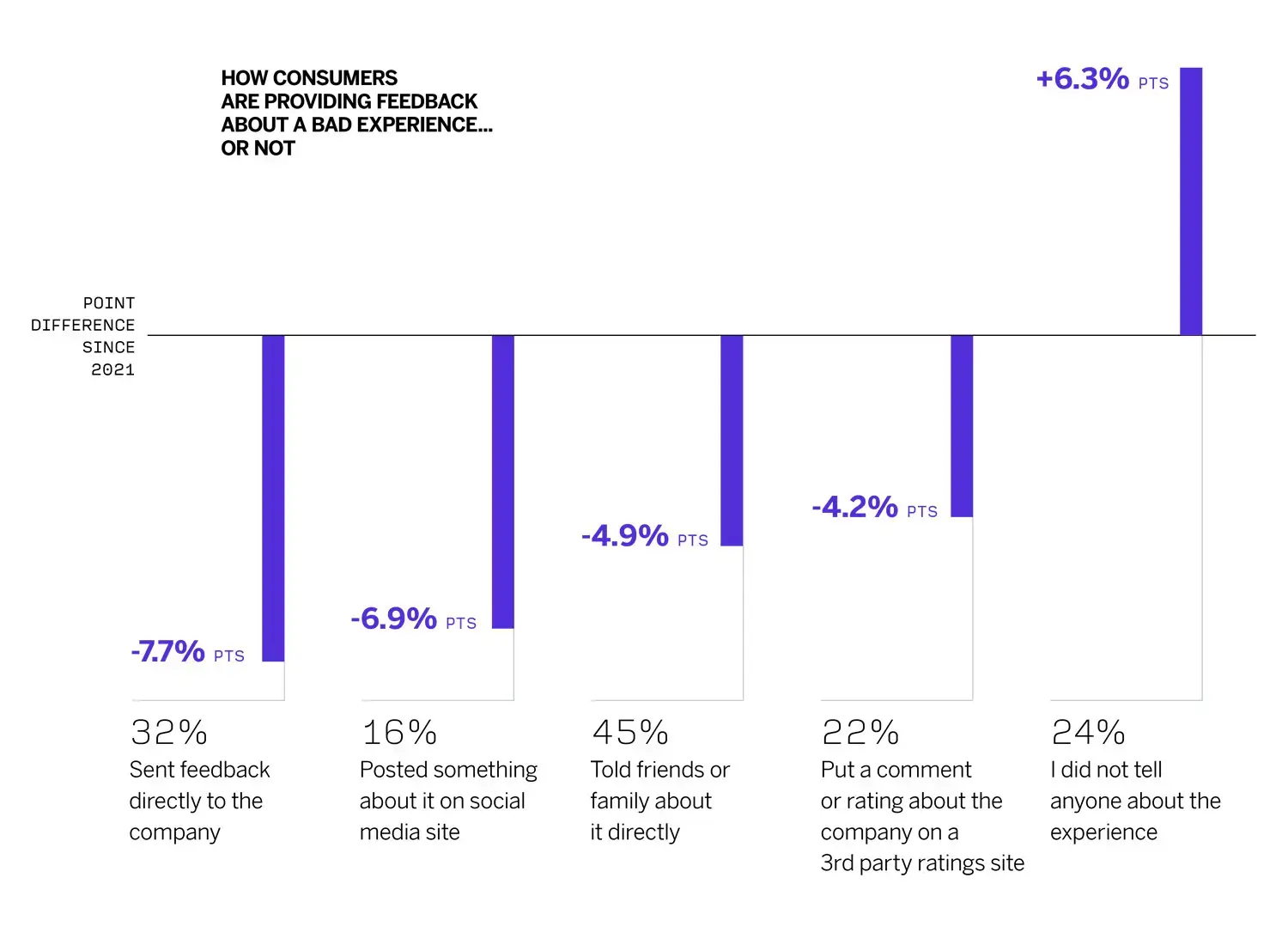

People might not fill out surveys as regularly, but they’ll complain on social media, right? Well, some people might. In truth, only 16% will use social media to air their grievances (down 6.9pts from 2021), and only 22% will write something on a third-party review site (down 4.2pts).

Overall consumers are telling organizations about their poor experiences less, making it tough to for them to understand how to improve the experiences they deliver. The answer here – which we go into in our full Consumer Trends Report – lies in using sophisticated tools that can extract CX insights by analyzing consumer behavior and heuristics on a deeper level. It’s about how broadly your VoC program can listen, in other words – by casting a wider net for customer feedback.

Learn to listen, even when you aren’t asking questions. Pull those reviews, that social data, the calls, the emails. Save the moments of asking questions for when it really does need to be a more structured conversation, and then keep it very short and to-the-point.

- Elizabeth ErkenBrack, Qualtrics RVP Strategy and Solutions, Financial Services

When you’re listening on a more interconnected level, you not only extract insight from every call, social media post, email, live chat and piece of user generated content; you’re also discerning UI issues from session replay rage clicks, and predicting what’s next from lifelong customer history data.

Trend 4: AI hype gives way to skepticism

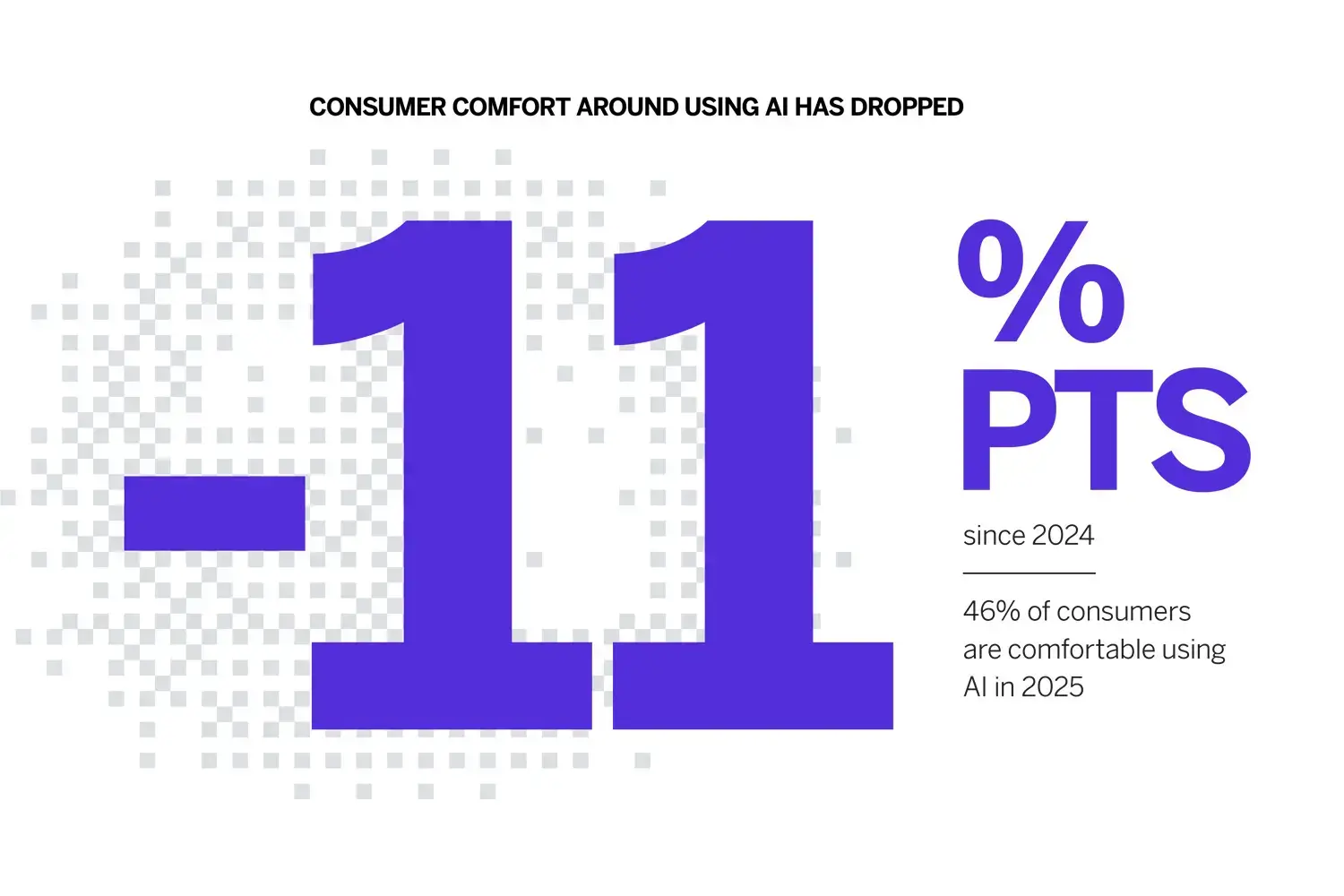

It seems like you can’t go a day without a brand telling you their latest products or services are powered by AI. So while businesses might be buying into the hype, it’s starting to turn consumers off. As consumer concerns continue to evolve, businesses will need to stay one step ahead to ease concerns if they want to grow adoption.

Comfort with using the technology is down 11 points YoY, while only one in four say they trust organizations to use AI responsibly. In CX, there’s a growing worry that AI-powered tools will come between consumers and the ability to speak to a real human being – a concern now shared by one in two people.

Concerns around AI continue to evolve

- 43% - Misuse of your personal data

- 41% - Poor quality of the interactions

- 51% - Lack of a human being to connect with

- 44% - Loss of jobs for employees

- 29% - Extra effort for you in the interaction

- 28% - Don't trust the information provided

AI can be a transformational tool for businesses, but success lies in its application. For brands looking to implement AI into their toolsets in 2025 without shedding customers, they’ll need to understand how it can best supplement, rather than supplant, the humans behind the business.

Trend 5: Today's consumers want privacy and personalization

This one’s a tightrope. On one hand, consumers have a preference for personal experiences that are designed just for them. On the other, many consumers don't trust companies to be responsible when using the type of data required to make that possible.

Consumer preferences show that 64% want to buy from companies that can offer a tailored experience, while more than half (53%) voiced concerns about the privacy of their personal information.

That’s tricky because you need customer data in order to enable that deeper personalization.

In many instances, it might be better to provide the benefit of personalization (accurate segmentation, enhanced service responses) without making the personalization itself too explicit.

- Leonie Brown, Qualtrics Principal XM Scientist, CX

The best way to handle this is to make best-practice CX decisions that build trust. Trust makes a huge impact on just how comfortable people feel with businesses using their personal data. That comfort score rises by 11 points when consumers inherently trust the brand, compared to when they don’t.

What matters most to consumers in 2025?

While spending naturally reduces when belts are tighter, businesses can accrue loyal customers by building the one thing that matters most: trust.

In tough economic times, consumers want to stick with brands they know well and can trust. That means feeling welcomed and having faith that if something goes wrong, the company will care about fixing the issue.

- Leonie Brown, Qualtrics Principal XM Scientist, CX

Trust plays an instrumental role in everything from online shopping habits to consumer beliefs, and it’s how you can encourage repeat purchases in a market where chopping and changing brands has never been easier.

Building trust comes from delivering on the basics before chasing trends and giving customers exactly the service you’ve sold to them.

Ultimately, trust drives consumer confidence, which influences their willingness to spend with you – rather than a competitor.

How technology can help you get closer to your customers

AI drives some of the most game-changing experience management tools, but it’s also the overplayed hype du jour – and that overexposure is driving skepticism in many consumers.

But AI in CX doesn’t need to be a visible layer, nor does it necessarily need to be the Generative AI chatbot that’s front and center for your contact center. Instead, AI can be used to help your frontline customers deliver experiences that really surprise and delight consumers every time.

Machine learning, natural language processing, and end-to-end consumer behavior analytics are all AI-powered tools that can help CX teams fine-tune the experience they have to offer on every level and on every touch point.

As consumer trends and shopping habits evolve, businesses need to adapt to people’s changing needs. Fortunately, the right technology can do a lot of the heavy lifting. Here are the key benefits:

- With more listening tools at your fingertips, you can go beyond surveys to meet your customers where they are to hear how they really feel. With today’s consumers giving less feedback directly, diversifying your listening tools is vital to staying in touch with your customers. Otherwise, it’s just guesswork.

- Automatically turn that feedback into insights so you can understand every customer on a deeper level – what they want, how they feel, what they like and don’t like. Empower your frontline teams with the tools, time, and insights to build stronger connections with your customers.

- Keep track of the end-to-end journey – no matter how complex it gets – so you know what’s working, what’s not, and where to focus your efforts to keep customers happy and your frontlines running as efficiently as possible.

Download the full 2025 Global Consumer Trends report below. Alternatively, learn how Qualtrics® XM for Customer Experience™ can stop customer issues from becoming lost revenue.

Dive deeper into the 2025 consumer trends