Written by: Will Webster

Fact Checked by: Karen Goldstein

What is a focus group?

Focus groups are a type of qualitative research that bring together a small group of people representing a target audience. In a conversation usually guided by a moderator, this group will discuss a specific topic, products, services or concepts in a controlled environment.

The purpose of focus groups is to have a relaxed, open-ended conversation to gain insights that may not be possible from a survey or individual interview. They’re a very valuable tool in the research toolkit.

Free eBook: 2022 global consumer trends

Focus group roles

In any focus group there are typically three main roles being played.

| 1 | Participant | They’re there to contribute to the discussion – sharing their thoughts, feelings and experiences – and provide the qualitative data focus groups exist to gather. They are typically chosen because they represent the target market or demographic being studied. |

|---|---|---|

| 2 | Moderator | The moderator’s role is to guide the conversation and focus group participants. They’re there to introduce the purpose of the focus group, lay the ground rules to the group members, and create a safe and respectful environment for discussion. The moderator should both follow a discussion framework and be prepared to adapt to the flow of conversation. Although rarely common, there can be two moderators in some types of focus groups. |

| 3 | Observer | The observers are there to, well, observe. They are typically members of the research team or the company conducting the focus group research, who watch the focus group discussion without participating. They’re there for several reasons: to hear the discussion live, to ask the moderator to probe on certain points of interest, to collect data, to observe body language and group interaction, and to gather any additional insights. |

When should a focus group be used?

Focus groups are a very popular type of research method that’s used in virtually every sector, from tech to academia, and marketing to political science.

Focus groups are a great choice if you want to go deep into a particular topic. If surveys are a brilliant tool for understanding what someone feels about something, focus groups help us to explore why – which is why the two work great in tandem. Focus groups give us an opportunity to capture the human element – the emotions and non-verbal cues that numbers often miss – and help us to explore underlying motivations.

Here are some of the most common focus group use cases.

New product or concept testing

If you’ve got a new product or concept in the works, a focus group can provide valuable feedback before you launch it into the market. You can get a sense of how people might react to it, what they like or dislike, and any improvements they might suggest.

In fact, focus groups are often used by brands to improve on and even co-create products in real time, with concepts discussed and iterated over the course of the session.

Understanding customers better

Focus groups are a great market research tool to help you better understand why customers think and behave the way they do. If, for example, a product isn’t selling as expected, a focus group with your customers can shine light on their barriers to purchase.

Beyond current customers, businesses can also use focus groups to better understand new prospects and bring their target customer segments to life.

Marketing and advertising

Before you invest a lot of money into a marketing or advertising campaign, you could use a focus group to test your messaging and visuals. Once any tweaks are made, you should be left with a campaign that will better resonate with your target audience.

Exploratory research

Focus groups are great when you don’t know what you don’t know. If you’re entering a new market or targeting a new customer segment, they can help you explore and understand the landscape.

When quantitative data isn’t enough

Sometimes, numbers and stats don’t tell the whole story. If you have quantitative data but want to delve deeper into the ‘why’ and ‘how’, focus groups are a great way to do that.

Focus groups can provide rich, qualitative insights that quantitative research methods might miss. But it’s important to remember that they aren’t right for every situation.

If you need to make definitive conclusions about a large population, a quantitative survey will be a better option. The same applies if you’re focusing on sensitive topics that people may not feel comfortable discussing in a group setting, such as financial or health matters.

At the end of the day, the best research method for your use case really depends on your specific goals, who you’re collecting insights from and the nature of the information you’re seeking.

Types of focus groups

Focus groups can take different forms depending on the objectives of the study, the participants, and the nature of the topic being discussed. Ranging from the common to the seldom used, here are the different types of focus group methods.

One-way focus groups

The classic focus group format: a moderator leads a discussion among a group of participants about a particular topic.

Two-way focus groups

Here one group watches another, observing the discussion, interactions and conclusions. This format is used to provide additional insights and a deeper understanding of the topic.

Dual-moderator focus groups

A focus group with two moderators. One ensures the session runs along smoothly; the other makes sure all topics are covered. The aim of this format is to create a more comprehensive discussion.

Duelling-moderator focus groups

Like dual moderator focus groups in that there are two moderators, but here the moderators take opposing viewpoints on the topic. The purpose of this format is to help the participants consider and discuss a wider range of points.

Respondent-moderator focus groups

Where one respondent – or several – plays the role of moderator. This format counters the unintentional bias that can come from a single moderator, and encourages variety in the discussion,

Mini focus groups, dyads and triads

Exactly as they sound, mini focus groups involve fewer participants than usual. These smaller groups – typically made up of 4 to 5 participants – are well suited to complex topics.

There are also focus groups involving two participants and a moderator – known as dyads – and groups with three participants and a moderator, which are known as triads.

Remote focus groups

An online focus group. This format is a great way to give your research a wider geographical reach and access a greater pool of people.

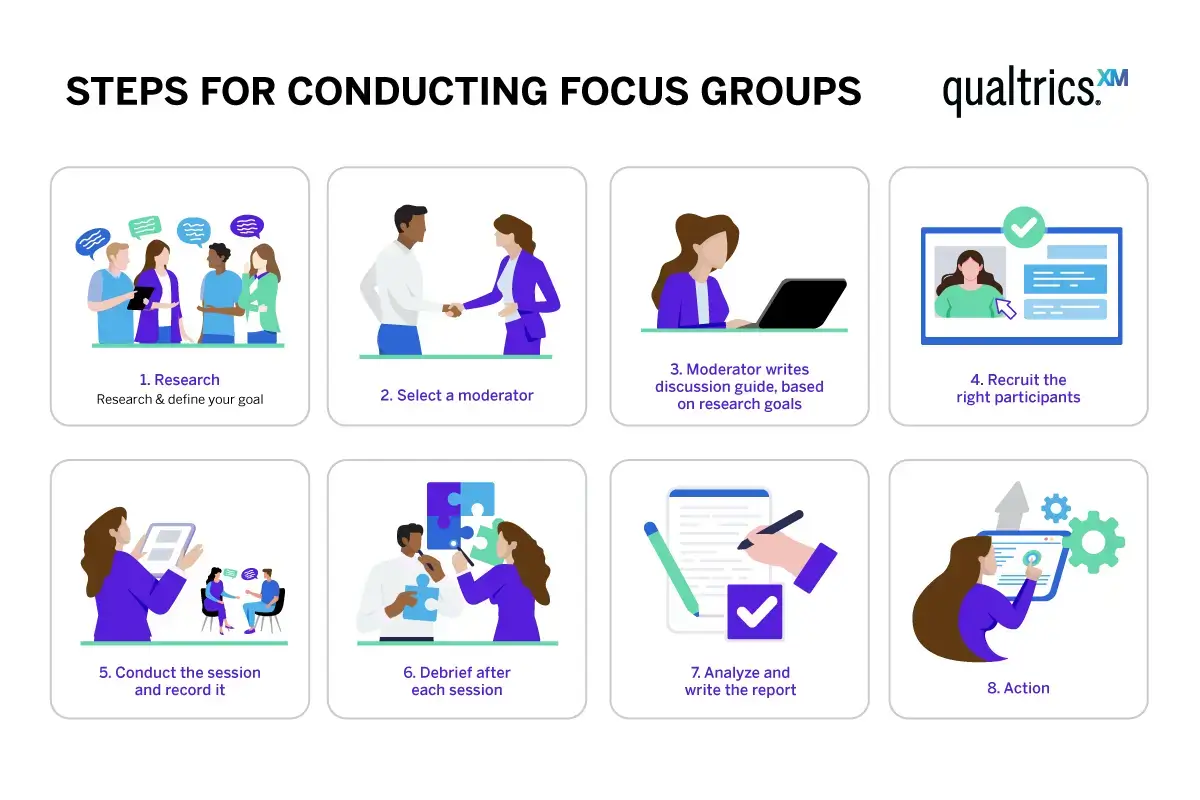

How to run a focus group: Step-by-step guide

The focus groups that generate the best insights are often those that are planned best. Here’s our guide for every step of the process.

1. Research and define your goal

The first step is to identify what you want to learn from the focus group. Are you testing a new product or exploring consumer behaviour? Maybe you’re seeking feedback on a marketing campaign or getting to know a new target market?

2. Choose a moderator

If planning is the key ingredient for a great focus group, a good moderator is a close second.

The moderator is the most important person in the room, and needs to be someone who can facilitate discussions, manage a group of strangers, and keep the conversation on track and be able to elicit the feedback desired..

3. Choose a location

The most important consideration here is how you create a comfortable, non-judgmental environment where participants feel safe to share their thoughts and opinions.

And you also need to answer the big question: in-person or online? In-person sessions typically enable better conversation and group chemistry, while online focus groups give you access to a much bigger, broader pool of potential participants.

4. Recruit the right participants

Next, work out who you need to participate in the focus group to reach your goal. Whatever your target audience is, you want the respondents to meet the baseline criteria – noting that the ideal size for a focus group is typically between 6 and 8 participants, and that none of your participants should know each other.

Once you’ve worked out who you want there, you need to recruit them. This is often done via ads, invitations to your CMS database or a third party. Incentives, like cash or gift cards, are typically used to encourage participation.

5. Create a discussion guide

In tandem with step four, it’s time for the moderator to develop a document that will guide the discussion. Based on your research goal or goals, this guide should include a list of focus group questions or topics you want to cover during the session, and strike a good balance between structured and flexible – so you can gather the data you need while not discouraging spontaneous conversation.

6. Conduct the focus group

The big day has arrived. With everything in place, all you need to do is make sure that every participant is given an opportunity to speak.

Don’t forget to record the focus group (with the participants’ consent) and make efforts to capture non-verbal cues from participants.

7. Debrief and iterate

Debrief after each session to understand your key findings, and if necessary, edit the discussion guide for future focus groups based on your learnings and observations so far.

8. Analyse and report on the findings

Now’s time to transcribe your recordings and analyse them for key themes and insights. The aim here is to interpret your findings in the context of your initial goal.

It’s best practice to present your key focus group results and findings in a report, alongside recommendations based on them.

How many people should be in a focus group?

The ideal size of a focus group is generally said to fall between 6 and 8 participants.Why is this the sweet spot? Because it’s small enough to ensure that everyone has a chance to speak and share their views, but large enough to provide a variety of perspectives.

That said, the goal of your research and the topic(s) you’re focusing on can change things. For instance, if the topic is particularly complex or sensitive, a smaller group may be better.

If you have a larger pool of potential focus group attendees, best practice would be to split them up and conduct multiple focus groups, instead of one focus group with too many people.

Focus groups vs in-depth interviews

Focus groups and in-depth interviews are two of the most popular forms of qualitative research. They do, however, differ in what they can bring to your research – which is why they’re often used in tandem to answer a single research question.

The benefits of focus groups over in-depth interviews

Focus groups are designed to encourage interaction between a collection of people, often revealing insights that may not surface in a one-on-one conversation. They give researchers an opportunity to observe group dynamics and how individuals influence each other and can be influenced themselves.

A big advantage of focus groups is their efficiency – in one session you can gather a broad range of insights from multiple individuals.

The benefits of in-depth interviews over focus groups

In-depth interviews are one-on-one discussions between a researcher and participant.

Whereas focus groups are by definition a group discussion, in-depth interviews provide a more personal and detailed exploration of an individual’s perspectives and experiences. Because of this, interviews are great for sensitive or personal topics, and the interviewee won’t be as influenced by others when giving their honest opinions – which is a risk with focus groups.

Another benefit of in-depth interviews is that the researcher/interviewer has greater control over the conversation, which gives you a greater chance of covering all topics thoroughly.

Advantages and disadvantages of focus groups

Like any research method, focus groups come with a variety of pros and cons that are typically associated with any type of qualitative research.

Advantages of focus groups

- They give you qualitative insights. Exploring the ‘why’ behind people’s behaviours, views and decisions

- They enable interactive discussions. Often leading to deeper insights as participants explore topics and ideas

- They give immediate findings. Observing real-time reactions means you can quickly implement them on a concept, product or campaign

- You can capture non-verbal data. Non-verbal cues and body language often give a further layer of insight into participants’ attitudes and feelings

- You have real-time flexibility. The moderator can steer the conversation to explore new points and topics if they arise

Disadvantages of focus groups

- Your sample size is small. And less likely to represent how the total population feels

- You’re at risk of conforming beliefs. Meaning that participants may change what they’re saying to match the majority opinion or the loudest voice

- They require a skilled moderator. Your findings could be a lot less valuable without one

- Data analysis can be time consuming. If you’re hosting multiple groups, transcribing and deciphering data can be labour-intensive and complex

- They can be expensive (especially if done in person). You may need to pay for participant travel, accommodation and incentives, venue rent and even moderator fees

Get all the data you need for free with Qualtrics™

Focus groups can be a powerful research tool, but they’re not without their complexities. If you want sophisticated research made simple, try Qualtrics.

Trusted by everyone from researchers to academics, over 11,000 brands and 99 of the top 100 business schools, Qualtrics’ suite of market research solutions provide endless applications through a single platform – from market segmentation to competitive benchmarking, and trends to purchase behaviour.

Create a free Qualtrics account today and deliver the results that matter.

Free eBook: 2022 global consumer trends