What is brand health?

Brand health is the way a company or brand delivers on its promises to customers. The more delighted customers are with the product or service, the better the brand’s health, and the stronger your brand positioning.

Rob Rush, of Deloitte & Touche LLP sums brand health up like this: “In short, the closer a customer experience is to the brand promise, the healthier the brand.” Or, in other words? A healthy brand delivers consistent, positive, and polished experiences for customers, employees, and everyone in-between.

Free eBook: How to Manage Your Brand in Times of Change

Being ‘healthy’ across a range of key metrics and measures is how we assess a brand’s success.

Why track brand health?

While you can measure your company’s financial success using sales figures, measuring your brand health needs a different set of tactics, with the view being to understand:

- What people think of your brand (brand perception and brand reputation)

- How memorable your brand is (brand recall)

- How people interact with your brand (brand attributes)

- How people buy and use your brand (brand purchase and brand positioning)

Brand health tracking is essential, to:

- Understand how your brand performs for your target audience

- Inform where to direct your marketing strategy and budget

- Flag up any negative trends and address them immediately

- Benchmark against the competition

- Assess the effectiveness of your advertising

- Identify your brand advocates

- Achieve brand equity

- Monitor your brand’s health overall

When you plan a brand strategy, brand tracking should be built-in right at the beginning. Ultimately, it’s how you measure brand health results.

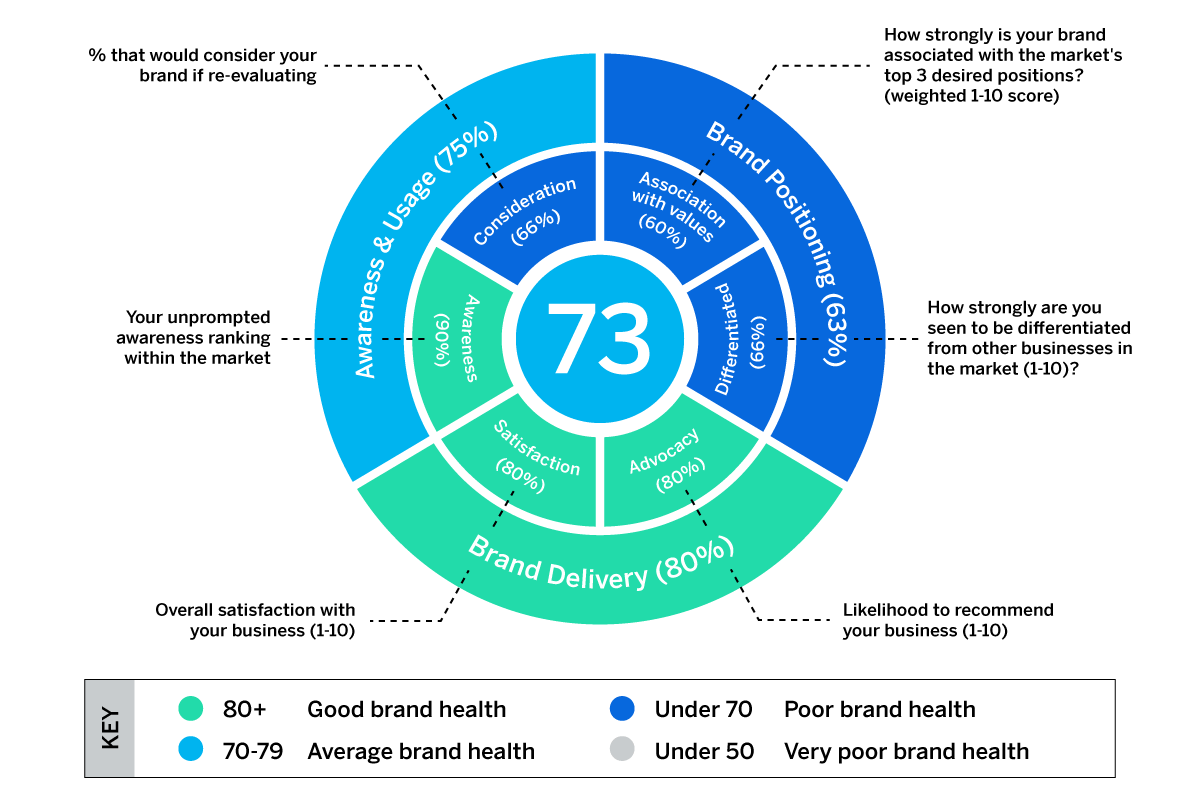

Brand health metrics

Before you start measuring brand health, it’s worth understanding the key brand health metrics – the scores and figures you can keep track of regularly and relatively easily. These metrics combine to create a larger picture of brand health as a whole:

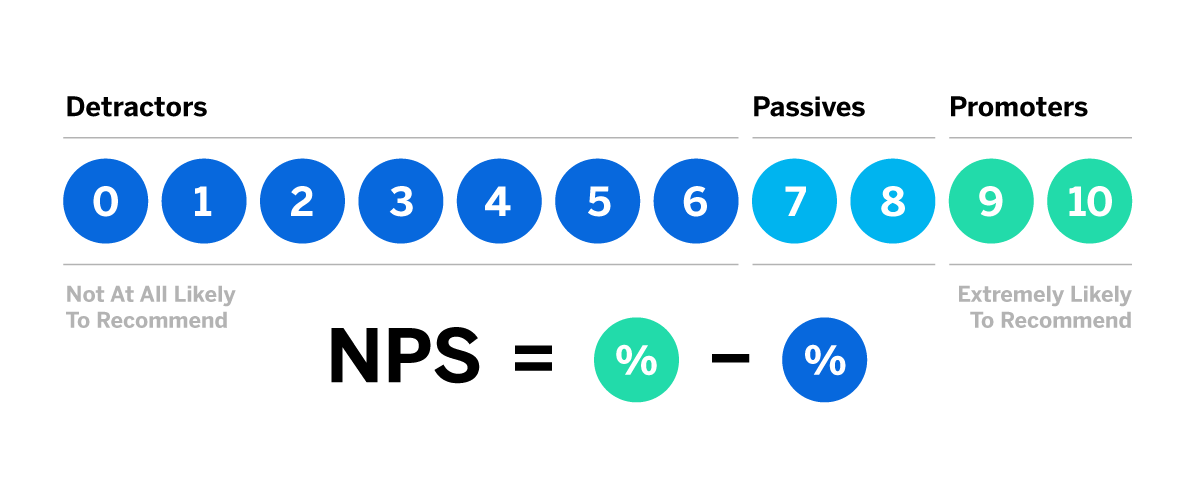

NPS (Net Promoter Score) and CSAT

NPS and CSAT are great indicators of customer loyalty – the world’s most valuable brands routinely score highly in both these metrics because they put a strong focus on the customer and the relationship they have with any given business.

NPS is used by millions of businesses to measure and track how they’re perceived by their customers and is, therefore, a great indicator of brand health. It measures how your customers feel about you based on one very simple question:

- How likely is it that you would recommend [Organisation X/Product Y/Service Z] to a friend or colleague?

Respondents give a rating between 0 (not at all likely) and 10 (extremely likely) and, depending on their response, fall into one of 3 categories:

- Promoters respond with a score of 9 or 10

- Passives respond with a score of 7 or 8.

- Detractors respond with a score of 0 to 6.

Your final NPS score can be calculated by subtracting the percentage of detractors from the percentage of promoters.

CSAT is short for customer satisfaction, and is measured by asking customers a variation of this question: ‘How would you rate your overall satisfaction with the [goods/service] you received?’

Respondents use a 1 to 5 scale:

- Very unsatisfied

- Unsatisfied

- Neutral

- Satisfied

- Very satisfied

Calculating your CSAT score is done via the following formula: (Number of satisfied customers (4 and 5)/ Number of survey responses) x 100 = % of satisfied customers.

Share of voice

Share of voice monitors how much of the online conversation you’re winning over your competitors, making it one of the most important brand health metrics there is.

Share of voice is an especially useful tool for brands in niche industries whose products might not incentivise conversation in huge numbers, because – while customers may not be inclined to talk about you often – if they talk about you more than your competitors in the same industry, then you’ll know your brand health is reasonably high. That’s so long as the next metric is also in good shape…

Brand sentiment or brand reputation

Brand reputation is a reading of how people feel about your brand, on a three-point scale:

- Positive

- Neutral

- Negative

Most social listening and brand experience tracking software suites offer sentiment analysis as standard, which involves scouring the web for mentions and using AI to determine the sentiment behind people’s messages. It’s a very simple yet powerful way to get an overall view of the public’s opinion.

Brand recall

Brand recall is how we track brand awareness, both in your category and as a whole. As an example, a survey might ask your target audience the following question:

- ‘What brand comes to mind when you think about toothpaste?”

The answers are expressed as a percentage (of those who could recall your brand unprompted), which helps us gauge the extent to which a brand is present/salient among consumers.

Purchase intent

As with NPS, CSAT, and brand recall, purchase intent is a metric derived from surveys or questionnaires. It usually uses a variation of the following question, with answers on a five-point scale:

- “How likely are you to buy from [your brand]?”

The score is then calculated by taking the number of ‘very likely’ answers and dividing it by the total number of respondents.

Brand equity

Brand equity takes several of the above metrics to produce an overall view of your brand’s place in the market:

- (Purchase Intent + NPS) x 100. That creates your Brand Strength score.

- Then, (Brand Strength x Unprompted Recall) x 100 = your Brand Equity.

Brand tracking: How to measure brand health

Now you know the metrics, you can start your own brand health study. There are lots of brand tracking measures available, but the thing to remember is you don’t have to use every one of these. Cherry-pick the basics, and the ones that are relevant to your business right now.

![]()

As you grow, you can bolt others onto your brand tracker.

Brand awareness and brand perception

Use survey questions to measure brand awareness that cover both your business and your competitors. Use aided and unaided questions to capture respondents’ awareness of your brand.

Download our free brand awareness survey template

Bran perception is what customers believe a product or service represents, not what the company owning the brand says it does. These judgments on brand reputation can come from buying the product, reading an online review, comparing experiences of it with friends, or talking to your staff. Surveys, focus groups and forums, and social media listening will help you measure brand perception.

Brand attributes and associations

This measures the thoughts, opinions, and experiences customers associate with your brand and their expectations. Use statement-type questions on a Likert scale (Strongly Agree to Strongly Disagree). You can collect opinions on product features, and how the products fit into their lifestyle.

Brand loyalty

When customers are treated well, satisfied with the product/service, and the brand values chime with their personal values, they will be loyal.

In short, any brand tracking loyalty needs to meet customer needs. NPS is the classic metric for measuring brand loyalty: On a scale of 0-10, how likely are you to recommend [brand] to your family and friends?; as is Customer Lifetime Value.

- Master brand health metrics:

Download your free NPS survey template now

Brand preference and usage

Brand preference tracks the number of consumers who prefer to buy your branded product over the same product from a competitor. You can use a list of tick boxes of other brands, and ask the question: \Tick which brand of [product] you prefer to buy.\

Tracking brand usage will tell you how often consumers purchase your brand’s product or service. Use tick boxes labeled with your brand and competing brands, and ask respondents: \Please select which of the following brands you buy or use regularly.\

Brand purchase

Identify previous or existing customers by asking: ‘Have you purchased [product] from [our brand] before?’

Brand tracking

Track your brand funnel and how well you move the market from brand awareness to advocacy.

Ad concept testing Measure the strength of your ad concepts before you spend your budget on taking them to market

Customer insights

Conduct research that reveals hidden customer insights only you know about.

Brand positioning

Optimise your brand positioning by measuring the reaction to different value proposition candidates.

Message targeting

Understand how well your messaging is resonating with different consumer segments.

X+O-data integration

Understand how your brand and business KPIs interact and affect each other. Is your marketing driving growth?

Website metrics and social media listening

There are lots of website traffic measurers to track, but probably the most important ones are value per visit, total site traffic, traffic sources, conversion rate, lead generation cost, bounce rate, average session duration, interactions per visit, top pages, and exit pages. And you can go beyond analytics with website feedback surveys.

Likewise, listening to social media is essential for any brand. There are also social media marketing metrics you’ll need to track, including reach, engagement, shares, referrals to your website, click-through rate, bounce rate, conversions, and cost per conversion.

Potential causes for declining brand health

Has your brand lost its way? Lost its market share or share of voice? Maybe it has even lost its soul? For once-mighty brands that are gradually losing their grip, there are often more questions than answers:

- Has our brand changed, or have our existing customers?

- Has brand reputation been affected?

- Is our offering outdated?

- Is our brand promise not chiming with the upcoming generation?

- Has our advertising gone stale?

- Is this a product problem or an image problem? Maybe both?

Shrinking brands often find that they are suffering from one or more of the following market problems. Your brand may have:

- An experience that is out of sync with the rest of the market

- Expanded into too many markets and has lost its essence

- Become stale and no longer creates excitement with customers or employees

- Had its health ignored for too long and is showing signs of fatigue

- Become mired in the past, and hasn’t evolved with new buyers

- Had its focus narrowed and lacks sufficient channel distribution

- Found itself in a dying market

- Been reduced merely to a commodity

How to heal a sick brand

Brands that need a turnaround should start with a 3-point game plan:

1. Diagnose the problems

A brand can lose its way for many reasons, but it’s not always immediately obvious that it’s happening.

A brand will begin to show symptoms of decline here and there, little-by-little, without a sudden drop off (unless dealing with a crisis – but even those can be recovered from)

You might notice:

- A modest shrinkage of market share

- Some anecdotal comments from buyers about switching brand

- Less loyalty among buyers

- Competitors feeling a little bolder and beginning to score wins more often

- The media does not seem quite as interested in your brand as it was, and people are talking about it less.

Many brand managers won’t pick up on the problem until something sets off an alarm, and then suddenly the entire business is thrown into a panic.

This is often the most dangerous time for a brand because distressed executives and marketers may respond with knee-jerk actions, make rushed decisions, and overreact to the problem. Everybody will have an opinion about what to do, but that’s also part of the problem. You don’t need opinions – you need data.

To diagnose a brand, you need quantitative and qualitative data to ascertain:

- Do customers believe your brand has stayed true to its original values?

- If so, are those values still in harmony with those of customers?

- Has your brand’s messaging and value proposition become less desirable? Is it still meeting customer needs?

- Is your brand’s positioning less compelling than those of competitors?

- Are your products still solving pain points and delivering enough value?

- Is your brand consistent in its marketing, customer experience, and product value?

2. Set turnaround goals and take action

Once you have diagnosed the root of your brand’s atrophy, the next step is to lay out and work towards turnaround goals for the short term (6-12 months) and the long term (13-36 months).

These goals may include:

- Improvements in your NPS and Customer Lifetime Value – indicators of loyalty

- Pre and post-campaign performance standards

- Increase in market share

- Brand funnel improvements

- Product quality standards

- Employee engagement objectives

3. Measure your progress

You can only know that your brand is back on track when your metrics tell you they are. Without measuring improvement, you can’t determine if all your efforts are paying off. Use a selection of the tools mentioned above to measure your brand turnaround.

How CX and EX affect brand health

Many of the metrics and measures listed above all come down to how well you’re managing the customer experience (CX) and the employee experience (EX).

The customer experience is a multi-faceted thing to try and steer, but the right CX management tools can help you track pain points and take action before things become a reputational hazard.

At Qualtrics we help brands by using machine learning, natural language detection, and real-time monitoring to build a holistic view of every customer’s journey, and highlight bespoke ways that each and everyone can be improved.

EX, from recruitment to exit, also needs to be tightly managed in order to avoid brand health decline beginning from the inside. Companies that invest in employee experience are found to be 4x more profitable than those that do not, so it’s an important thing to build into your brand health management. Here’s how.

How to Manage Your Brand in Times of Change