Author: Adam Bunker

Subject Matter Expert: Topher Mitchell

What is customer retention and why does it matter?

Customer retention is a metric that measures the percentage of customers stay with your business over time. In super simple terms, your retention rate is the number of customers remaining active after a given period, divided by the average number of active customers during the same period.

This is the inverse of customer churn, which measures the proportion of customers that have been lost over time.

While customer acquisition is important to any business, customer retention is a similarly important business strategy to focus on, since losing customers can be incredibly costly.

In fact, understanding, monitoring, and building retention is an essential part of meeting customer expectations. Retaining customers is both how you’ll improve your business’ core KPIs and a practice that – by simply taking the right steps – will yield a host of other benefits.

By focusing on ways to increase customer retention, you’ll also…

Improve customer satisfaction

Existing customers who are incentivized to stick around – that is, the ones who feel listened to, understood, and valued – are much more likely to feel satisfied with your services. Handily, satisfied customers are much more likely to recommend your brand to their peers too, which can boost overall customer acquisition figures.

Identify areas for improvement

Customer feedback, when conducted through the lens of improving retention, is an incredibly important resource for continuous improvement across the business – especially in closing experience gaps you might not otherwise realize were there.

How to measure customer retention rate

Measuring customer retention isn’t a ‘one-and-done’ activity — it’s an always-on process that needs careful monitoring to ensure you’re moving in the right direction.

Many organizations will use customer experience software to monitor retention, understand their customers better, and take action to evolve their retention program to react to customers’ changing needs.

The first step here is to calculate your customer retention as a metric. It’s a pretty simple calculation – your customer retention rate is usually expressed as a percentage of customers retained in a particular period.

Retention Rate = Number of active customers* at the end of a given period / Average number of customers during the period

*The definition of ‘active’ can vary from business to business. This could be a paying subscriber, a customer within a yearly contract, or a user that regularly uses a feature or service.

But that time period matters. Customer retention and churn rates are often monthly or annual numbers, so you’d normally record the time period along with the percentage, as follows: “X% annual customer retention rate” (assuming that is the period you’ve measured).

It’s also important to note that customers are so diverse, and their motivations so complex, that one metric alone can never reveal the full story. Instead, you’ll want to combine customer retention rate with a whole host of other experiential and operational data – that way you can better understand what’s causing churn, and what drives retention.

What is a good customer retention rate?

The truth is that it’s hard to pin a definitive number on ideal customer retention – it’s a holistic metric. Some customers simply aren’t profitable by nature, some cost too much to retain, and – ultimately – organizations have finite resources. So it’s about prioritizing investments appropriately rather than striving blindly for 100% retention.

It’s helpful to have some kind of rough benchmark though, right?

Average customer retention rates do vary by industry, after all. According to research by Statistica conducted in 2020, here’s an average read on how things differ across various sectors per year:

- Retail: 63%

- Banking: 75%

- Telecom: 78%

- IT: 81%

- Insurance: 83%

- Professional services: 84%

- Media: 84%

How to increase customer retention

Customer retention management is the formalized process through which organizations manage the relationships with existing customers to encourage them to stay longer and spend more.

In B2B, this is usually managed by a customer success team that builds close relationships with individual accounts and customers, working closely with them to retain and grow the account over a period of time.

In B2C it’s slightly different – while you might have a customer retention team, it’s almost impossible to build 1-to-1 relationships with every customer. So instead, the customer retention team usually sets a strategy and works closely with other customer-facing teams from across the organization to deliver on it.

For example, your customer retention team may look to introduce personalized offers for certain customer segments in a bid to boost customer loyalty. They may then look to the marketing team to help them establish regular communication with those customers.

Or, you may offer a special discount or price for those at risk of customer churn. This is something you’d likely have agreed with the product team and then communicated to your contact center agents, giving them something to offer customers if they phone to cancel a contract, for example.

Here are 9 ways you can make customer retention management a focus in your business:

1. Track customer retention in real-time

You need to know how your retention strategies are working – and the only way to do that is to measure. While you might formalize retention figures periodically, say quarterly or annually, the best brands have always-on data, showing them day-to-day what’s happening to their retention rate.

2. Understand the bottom-line impact

It’s essential to understand how much churn is acceptable, and which customers you are happy to let go. So make sure you include operational data about which customers are churning.

It’s useful here to have a metric like customer lifetime value (CLV) to refer to when deciding which customers you want to invest in retaining. Connecting with operational and finance teams is a good start – can you use the data at hand to attribute CLV and/or a value you can pin to your customers? That way, you’ll be in a better position to understand the cost of churn – and this can help unlock business-wide buy-in for activities aimed at plugging those leaks.

3. Understand why people churn

If customer retention is the antithesis of churn, then it pays to understand what causes people to leave a business in search of competitors.

There are four kinds of churn drivers to watch out for, each with two sub-categories:

| Churn cause | Description | Type 1 | Type 2 |

|---|---|---|---|

| Service failures | Service failures occur when any interaction or service falls short of customer expectations. | Ordinary: Long wait times, a poor-performing website, lost luggage, products out of stock, poor product experiences, or missed delivery dates. | Catastrophic: Identity theft from a company database, an altercation with a staff member, or a credit card decline for an important client dinner. |

| Failure to compete | A competing product or service outstrips what your business has to offer. | Inadvertent: Being blind to the existence of competitor offerings, the value competitors offer, or the value customers seek. | Intentional: A conscious choice is made not to compete with a direct or indirect competitor. |

| Category retirement | This occurs when a product or service is no longer needed by a customer or market segment. | Inevitable: This happens when a product or service is targeted at one specific part of the customer journey, which the customer then moves past. | Avoidable: Customers sometimes simply leave a category when a suitable substitute arises – it might be the case that the product in question has failed to adapt to their evolving needs. |

| Structural barriers | Roadblocks that prevent customers from acting as they normally would when choosing products or services. | Organic: Pricing or store locations that naturally exclude certain clients. | Synthetic: Unpredictable barriers that stop a business from reaching their customer, like changes to legislation, or IP disputes. |

4. Seek out and fix customer pain points

Understanding what causes churn and working to promote retention both have roots in the overall customer experience – and improving that starts with understanding where experience gaps lie.

Doing so effectively requires being able to track and adjust CX across touchpoints. That means monitoring customer feedback – direct and indirect – in real-time, tracking user journeys through digital properties, and using AI-powered software to help human agents deliver best-in-class customer support. And it means doing all of those things in an interconnected way.

With the right software – like Qualtrics® XM for Customer Experience – you’ll be able to unearth previously hidden pain points by connecting all these disparate dots, and action change that promotes retention through superior CX.

5. Run CX experiments to increase customer retention

Ok, so you have data points that show pain points and potential hypotheses for bolstering your CX… What now? Improving the customer experience means improving every interaction your customers have with you – and eliminating many common causes for churn in the process.

Experiments are an excellent way for CX teams to establish causal relationships between the actions they are driving and the outcomes that interest them.

Correlations are great for prediction (“How likely is an unhappy customer to churn?”), but they’re not when it comes to proactive intervention (“If we improve their experience, will this customer still churn?”) or counterfactuals (“What would have happened if we hadn’t improved that customer’s experience?”).

You can learn more about this – and how to effectively run CX experimentation – here.

6. Share insights across the organization

Make a list of all the customer-facing teams that have an impact on retention, and make sure they have all the information they need to make the right decisions for customers, whether it’s designing a broader retention strategy or they’re on the frontlines making in-the-moment decisions that will drive customer satisfaction and ultimately impact retention.

Working with those teams, you can ensure that your customer experience program plugs into the systems they’re already using so they can take the right actions for customers in their day-to-day work.

7. Make use of email newsletters and personalized offers

When a customer shares their email address with you and opts into marketing messages, it’s a strong sign that they already feel positive towards your brand and your cue to build relationships. You can build on this and keep them onboard over a longer period by being a regular presence in their inbox. As email is a free channel, it’s a relatively low-cost way to improve customer retention.

That doesn’t just mean sending out blanket marketing messages though. For best results, use your CRM data to personalize emails to loyal customers and celebrate their relationship with the brand, focusing on key milestones. Try a birthday discount code or a message that lets them know they’ve been shopping with you for a year (or more) and thank them for their business.

Even better, try using automated emails that are triggered through their actions. For example, when customers make a purchase, send them an email explaining how that product or service works. Alternatively, when customers haven’t been involved for a predetermined period, send an automated email that is tailored to their past purchases to encourage them to return.

8. Pre-empt churn

As well as looking after the happy customers you have, extend your reach to the ones who have wandered off, or are about to. Reactivation for existing customers within the EU may have gotten trickier since GDPR regulations came in – you can no longer simply use a mailing list – but you can still reach retained customers who are showing signs of being about to lapse.

To discover which of your existing customers are at risk of churn, it’s helpful to have data showing how previous customers behaved in the same situation. Less frequent purchases of products and services, lower levels of engagement, or lukewarm feedback can all point toward a customer looking for an exit.

It’s another good argument for tracking your customer journeys and developing stronger customer relationships. It’s worth understanding why customers buying in a certain way do so, and how your products and services are being marketed through channels such as social media. Tying in all your understanding of your customers into their long-term behavior allows you to provide a much more tailored customer experience that will reduce customer churn.

9. Reward your best customers

Not all customers are created equal. Big spenders, repeat purchasers, and those who bring in new customers with referrals and reviews all deserve some recognition and a special effort when it comes to increasing customer retention. You can give it to them through a rewards program that ties extra benefits to customer loyalty behaviors.

For some companies, this is linked to spending – they might earn 1 loyalty point per $ spent, for example. For others, a multi-faceted strategy works better. The customer may receive a reward for leaving a review, recommending a friend, or following one of your social media accounts. Which option you choose might depend on the number of customers you have or your other business goals.

Regardless of the tactic, the underlying principles are the same — get to know your customers, what drives customer loyalty, and look to invest in the kinds of experiences they want, whether that’s rewards, discounts, or access to different service levels.

Great customer retention examples

1. Starbucks

Starbucks was something of a pioneer with its Starbucks Rewards program. Using its app, customers can earn rewards for every purchase to be used later on free food and drink. Payment needs to be made through the app itself, generating even more customer data that Starbucks can use to personalize its offerings.

Image credit: Starbucks

2. Amazon Prime

Amazon Prime is part customer loyalty program, part experience. Customers pay to receive benefits like same-day delivery, access to video and music streaming, and exclusive discounts and offers. But the knock-on effect for Amazon is a huge boost in retention – the subscription makes Amazon its members’ first choice when it comes to online shopping.

Image credit: Amazon

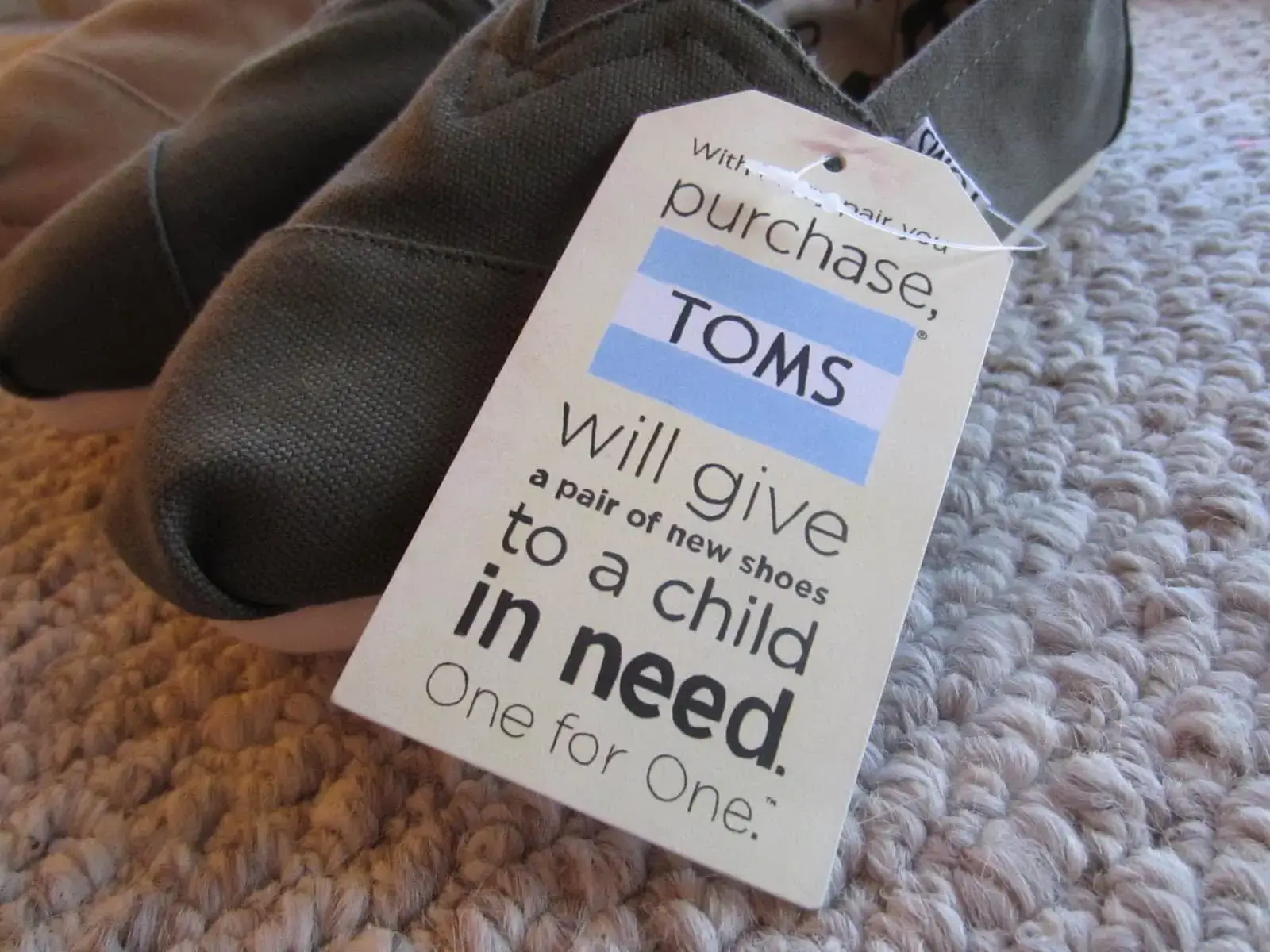

3. TOMS

A great example of understanding your customers is TOMS’ ‘One for One’ program. When customers buy a pair of TOMS shoes, the company donates a pair to people in need. It harks back to the company’s brand values and acknowledges that its customers are driven not by discounts and rewards, but by their desire to do good.

Image credit: Causemarketing.com

4. Nike

The sportswear giant understands that sport and exercise is a team game — people are much more likely to exercise as part of a group than on their own. So they developed apps and partnerships to build a sense of community like Nike Run Club, encouraging solo runners to team up with other runners online and replicate the sense of team and competition that many people demand.

Increasing customer retention: Four key takeaways

TL;DR? If you only take a few things away from this article about customer retention, make them these salient points:

1. Keep your metrics up to date

If you want to impact customer retention, you better know what your customer retention rate is over the last month, quarter and year – and how that compares to the previous corresponding period. CX professionals often want to improve retention without these benchmarks in place, making it impossible to understand positive change.

2. Build retention by understanding churn

It’s important to think about the other side of the retention equation – what are the reasons for customer churn? We outlined the four main churn drivers in this article; which of those reasons are addressable in your business?

3. Don’t throw the baby out with the bathwater

Increasing customer retention is not an excuse for making bad business decisions. As with any investment, you’ll need to determine whether what’s being proposed is worth it, whether that investment could be better spent elsewhere, or whether changes will actually cause a different subset of customers to churn. It’s not always true that retention costs less than acquisition, so you need to have a rock solid quantitative model around investment that can help you prioritize.

4. Employ the right tools for the job

Ultimately, if you want to turn customers into fans, you’ll need the right software. That means adding customer experience management software to your tech stack that can keep track of retention and customer churn rates 24/7, as well as generate actionable insights from every touchpoint, and every interaction – as they occur.

Qualtrics XM® is a platform designed to do exactly that. It uses AI and machine learning to turn typically disparate data sets into clear ways to move the needle, build exceptional customer service workflows, and bolster your customer retention efforts like never before.

Free eBook: The ultimate guide to improving customer loyalty